![]()

Expanded Gaming

Sports Betting & Casinos

![]()

How Virginia Sports Betting Revenues are Taxed

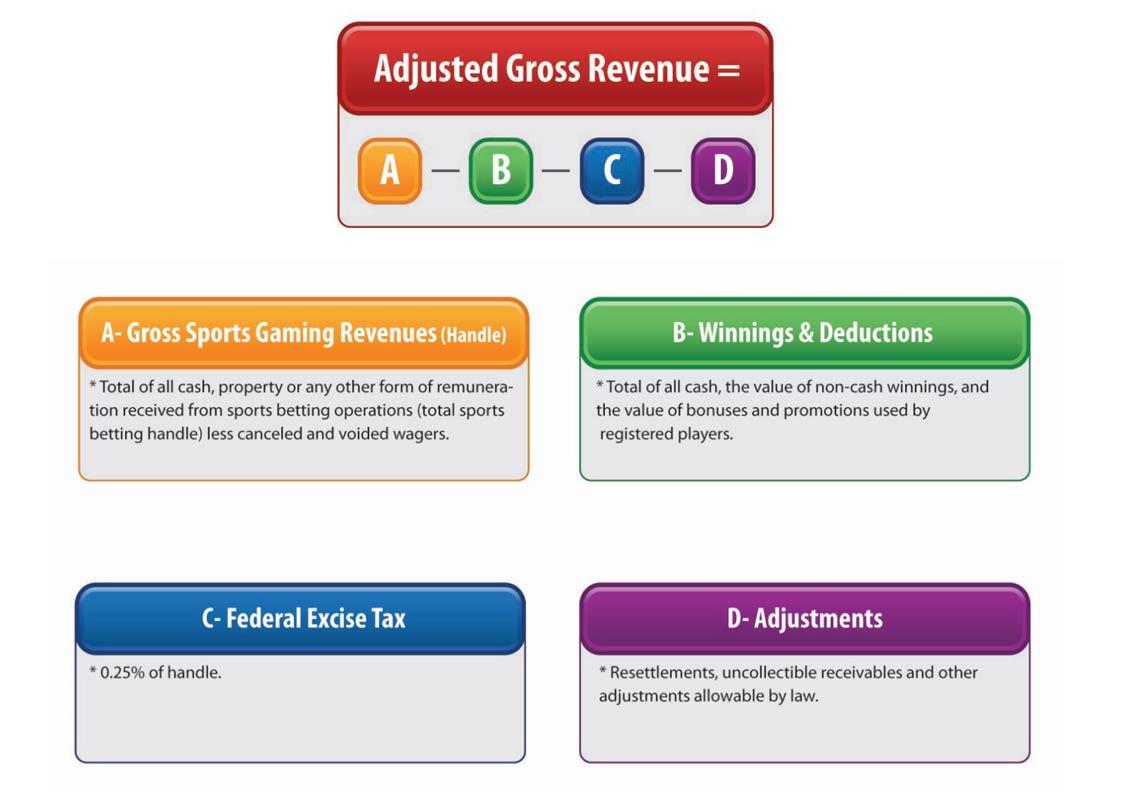

Sports betting activity is taxed based on a permit holder’s adjusted gross revenue (AGR), which the General Assembly defined in its 2020 legislation. AGR is calculated by subtracting from the amount wagered by players (the handle) all winnings and any legislatively-authorized deductions, including the value of bonuses and promotions offered as an incentive for consumers to place a wager. Operators also are allowed to deduct the federal excise taxes paid on the wagering activity.

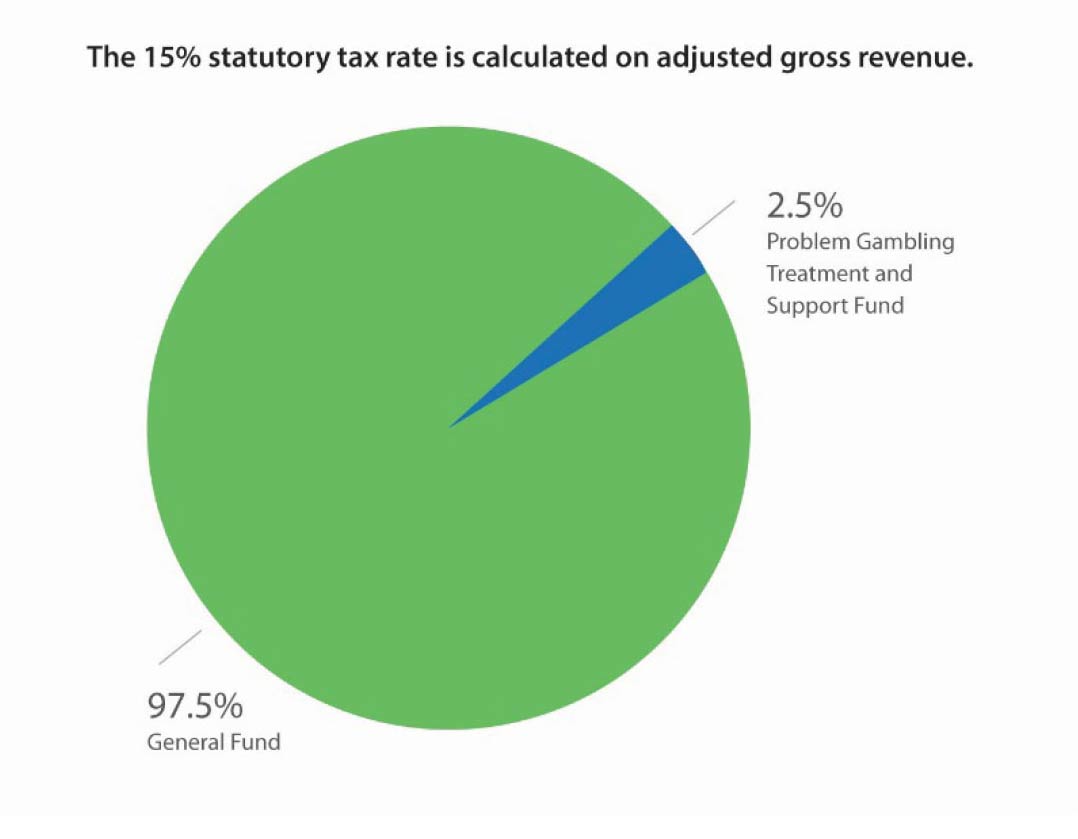

By statute, a tax of 15 percent on sports betting AGR is to be paid to the Commonwealth each month, with 97.5 percent of tax revenue to be deposited in the state’s general fund and 2.5 percent deposited into the Problem Gambling Treatment and Support Fund administered by the Virginia Department of Behavioral Health.