Newt Gingrich: Nothing in Biden's Build Back Better plan will fix inflation

Former House Speaker reacts to the president saying his spending will cut inflation on 'The Story.'

President Biden's massive $1.75 trillion spending bill would drop a component of the child tax credit program that could lead to billions in payouts to illegal immigrants.

Tucked away on page 1,647 of the Build Back Better Act, the Democrats' social spending package, is a provision that would repeal the Social Security number requirement to obtain child tax credits. This change would expand child tax credits to parents of illegal immigrants who don't have Social Security numbers.

Steven Camarota, a Center for Immigration Studies researcher, estimated that eliminating the requirement could result in up to $2.3 billion in additional child tax credit payouts to illegal immigrants.

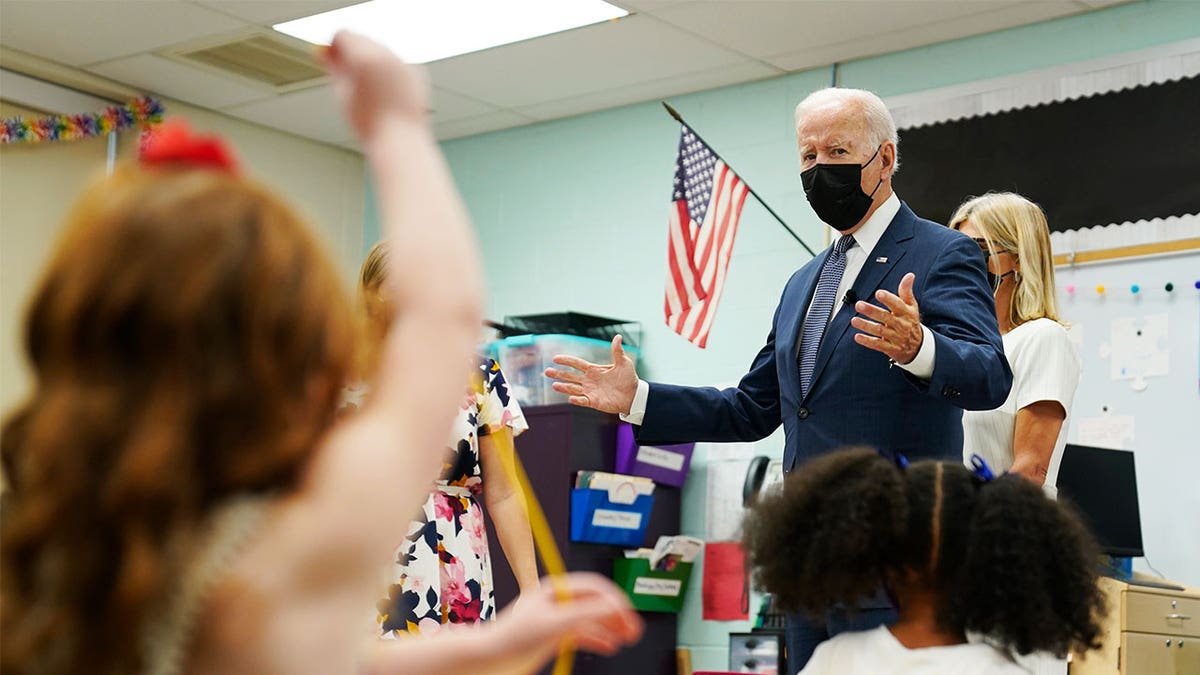

President Biden talks to students during a visit to East End Elementary School to promote his "Build Back Better" agenda, Monday, Oct. 25, 2021, in North Plainfield, New Jersey. (AP Photo/Evan Vucci) ( )

"Illegal immigrants are able to receive benefits on behalf of their U.S.-born children," Camarota told Fox News. "But the permanent elimination of the SSN requirement means that even illegal immigrants whose children are also illegally in the country can receive cash payments, including the roughly 600,000 unaccompanied minors and persons in family units stopped at the border in FY2021 and released."

Camarota also estimates an $8.2 billion payout from the expanded child tax credits to illegal immigrants with U.S.-born children.

"In addition to dropping the Social Security number requirement, receipt of payments for illegal immigrants is made all the easier because reconciliation also eliminates the work requirement for next year," Camarota said. "In the past, some illegal immigrants who worked off the books sometimes had trouble demonstrating employment income, but now that won't be a problem."

President Biden delivers remarks to promote his "Build Back Better" agenda, at the Capitol Child Development Center, Friday, Oct. 15, 2021, in Hartford, Connecticut. (AP Photo/Evan Vucci)

In 2021, the American Rescue Plan increased the maximum child tax credits from $2,000 to $3,600 per child under 6 years old and from $2,000 to $3,000 for children ages 6 to 17. The new proposal would extend these figures through 2022.

Working families currently get the full credit if they make up to $150,000 for a couple or $112,500 for a family with a single parent. Families who did not make enough to be required to file taxes are also eligible for the credits.

BIDEN SPENDING BILL WOULD BREAK HIS MIDDLE-CLASS TAX PLEDGE, ANALYSIS SAYS

The new legislation would eliminate the work requirement, which has caused friction between Sen. Joe Manchin and other Democrats.

"I believe government should be your best partner, but it shouldn't be your provider," the West Virginia Democrat said of the requirement. "We have a moral obligation to provide for those who have incapacities, such as physical or mental. But everyone else should be able to help and chip in, so that's my mindset."

Sen. Joe Manchin, D-W.Va., delivers remarks to reporters at the U.S. Capitol in Washington, D.C., U.S. Nov. 1, 2021. (REUTERS/Jonathan Ernst)

The child tax credit extensions are not related to the Biden administration's floated idea of payouts to illegal immigrant families separated at the border.

CLICK HERE TO GET THE FOX NEWS APP

The White House did not return Fox News' request for comment.