No matter how much or how little money we have, we all have to eat to live. But the share of earnings that people must devote to securing basic survival is not the same for everyone. Food takes a much bigger bite out of the household budget for low-income families than for richer ones. And that means sales taxes on groceries hit harder at lower incomes. Most states either exempt groceries from state sales taxes entirely or have other ways to help offset grocery taxes for low-income people.

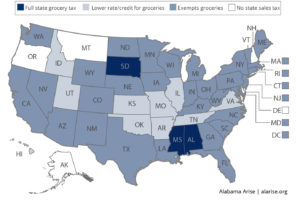

Alabama is one of only three states with no tax break on groceries. (Mississippi and South Dakota are the others.) Our state sales tax rate is 4 percent, but local taxes have driven the total rate to 10 percent or even 11 percent in many areas of the state.

Sales taxes are especially regressive in Alabama, because they apply to many kinds of spending that are not optional.

Sales taxes are especially regressive in Alabama, because they apply to many kinds of spending that are not optional.

A gallon of milk plus sales tax costs the same for a family at the poverty line as for a millionaire. But that sales tax makes up a much larger share of income – and has a greater effect on the household’s standard of living – for a low-income family than for a richer one. That means Alabama’s state grocery tax disproportionately affects households struggling to make ends meet.

Ways to untax groceries

Other states offer a range of options for how to reduce or end grocery taxes. Full exemption would ensure an immediate tax break on groceries for all state residents. (Food bought with benefits under the Supplemental Nutrition Assistance Program (SNAP) is not taxed, but those benefits cover only a portion of food costs for most participants.) The state also could tax groceries at a reduced rate or create a targeted Earned Income Tax Credit (EITC) to help offset grocery taxes for residents with low incomes.

No matter how Alabama seeks to untax groceries, the state should replace the revenue. Most state sales tax revenues in Alabama support K-12 education. Removing the grocery tax without replacing that money could cost schools more than $300 million a year. Alabama could recoup those funds by limiting or ending its state income tax deduction for federal income tax payments, a tax break that overwhelmingly benefits the richest households. The state also could expand sales taxes on more services and luxury goods.

It’s time for Alabama to join 47 other states in giving a tax break on groceries. It would make our state’s upside-down tax system more progressive. And it would be an important step toward boosting economic security for all Alabamians.