By Taylor Williams

In late October of last year, Raphael Bostic, president of the Federal Reserve Bank of Atlanta, gave a virtual speech in which he carried a glass jar with the word “transitory” labeled on it.

Inside the jar were wadded-up dollar bills, deposited by Bostic’s staff members each time they used the word “transitory” to describe the surge in prices of consumer goods and services. The exercise was meant to dispel the notion that the current inflationary environment would be fleeting or short-lived.

Based on the results of Northeast Real Estate Business’ annual reader forecast survey, commercial brokers and developers/owners in the region aren’t likely to be contributing to that fund any time soon.

Inflation Could Linger

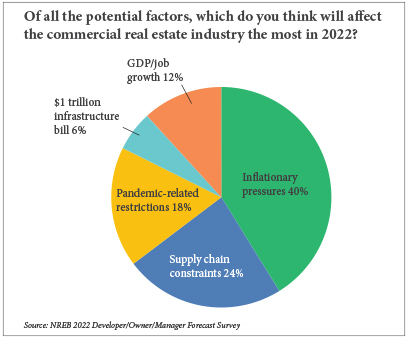

When asked to identify the macroeconomic force that was most likely to impact the commercial real estate industry in 2022, roughly a third of broker respondents selected inflationary pressures over supply chain constraints, pandemic restrictions, the $1 trillion infrastructure bill and employment/gross domestic product (GDP) growth. Concerns over pandemic-related restrictions on businesses, which adversely impact demand for space, was a close second among broker respondents.

Some brokers elaborated on these views in the free-response section of the survey.

“Continued inflation will result in less business expansion over the next few years,” wrote Bob Strell, an associate broker and consultant in the Buffalo office of full-service firm Hanna Commercial. “In addition, the cost of owning or leasing real estate is increasing at a rapid inflationary rate. Combined with a lack of direction from Washington, this will cause future uncertainty in the marketplace.”

“The inflationary pressure that we are currently experiencing will force an increase in interest rates, which will of course have a corresponding increase in capitalization rates on sales and valuations,” wrote Alan Simonowitz, director at New York-based brokerage and financial advisory firm Berko & Associates Commercial Real Estate Services.

“There will be cases where owners will not be able to refinance [their properties] without putting in their own capital because the loan-to-value of current property valuation will be higher than the current mortgage balance,” Simonowitz continued.

A different survey was circulated for developers, owners and managers. This group resoundingly chose inflation as the single-most disconcerting macroeconomic factor to watch for this year, with 41 percent of these respondents indicating that price increases embodied their biggest source of anxiety. This finding is understandable — developers face perpetually rising costs for construction materials and labor, the former of which has been especially roller coaster-ish since the pandemic began.

“The greatest challenge facing the industry [involves] surviving until 2023,” wrote one respondent who chose to remain anonymous. “Construction costs are up 10 to 15 percent; demand is stuck on 2020 pricing and giveaways. It will take a year or two for demand to catch up.”

Volatile construction costs, which are likely to become more unstable with the December passing of the $1 trillion infrastructure bill, would also explain why developers cited supply chain disruption as their second-biggest macroeconomic concern for 2022. Owners, meanwhile, will also face heftier operating costs in the form of labor, as well as through elevated property taxes and maintenance costs. (To learn more about what mortgage bankers in both the Northeast and across the country had to say about these factors in 2022, see the story on pages 18-19.)

It’s worth noting that the survey officially closed on Monday, Dec. 13, about a week before the nation began to see a major surge in COVID-19 cases, most of which were classified as the Omicron variant. In subsequent weeks, some investment banks cut their GDP forecasts for 2022 in response to the resurgences in cases.

According to data from Johns Hopkins University, the country set a new record on Monday, Jan. 3, when more than 1 million new cases were reported from over the holiday weekend. However, despite the rapid rise in cases from late December to late January, governments at the local, state and federal level have shown little interest in re-enacting lockdowns or mandatory business closures.

Inflation, however, tends to affect all markets more evenly. At the end of December, the Consumer Price Index, the key metric by which inflation is measured, was up 7 percent year-to-date, excluding movement of prices of the volatile commodities that are food and fuel. That figure, which is tracked by the U.S. Bureau of Labor Statistics, represented the latest data available at the time of this writing and marked the fastest rate of price escalation in 40 years.

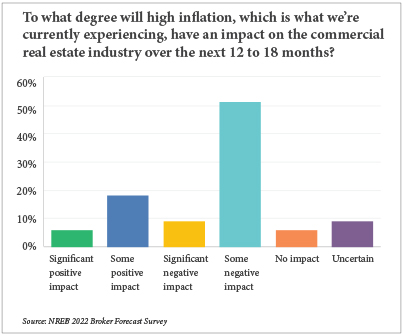

In a separate question, survey participants were also asked to specify just how severe the impacts of inflation would likely be on their businesses in 2022. Respondents were given five choices: significantly positive, moderately positive, significantly negative, moderately negative or no impact.

For their part, brokers took things a step further with this query. More than half indicated that the effects of inflation would be moderately negative. However, a few brokers (18 percent) indicated that inflation could be beneficial for their businesses. This response underscores a fundamental truth of the industry — a market factor that is detrimental to some can be helpful to others.

Owners may find the current market conditions to be advantageous in terms of achieving higher sales prices and valuations for their properties. This could in turn prompt more activity in the market as sellers are incentivized to sell at what could be the peak of the market. With that divergent piece of logic potentially in mind, developer survey participants displayed some bullishness with regard to their fundamental buy/sell position for the year. About 55 percent expect to be net buyers, while 23 percent see themselves as net sellers in the new year.

From a brokerage perspective, an inflated economy typically means higher operating costs for landlords, which are then passed on to tenants in the form of higher rents. But the question of how long the inflationary conditions will last represents the point at which the rubber meets the road.

If they believe inflation is here to stay, landlords may be reluctant to push rents on cash-strapped tenants whose businesses are hurting, particularly those whose leases are coming up for renewal. If property owners believe inflation will be relatively short-lived, they may do the opposite, thus prompting tenants to take second looks at their leases and potentially consider relocation options.

But both of those scenarios involve movement and negotiations, and landlords and tenants will both need brokers to advise them in either case. With this line of reasoning in mind, it follows that 95 percent of broker respondents stated that they expect their firms to do more (65 percent) or approximately the same (30 percent) volumes of business in 2022 as they did in 2021.

Real estate is a long game, and while inflation may not be transitory in the extreme short term, pricing levels should eventually moderate. In addition, real estate is a well-known hedge against inflation, given that it has less short-term volatility than the stock market and a significantly greater risk-reward payout than U.S. Treasury notes.

Other Macroeconomic Factors

As for supply chain disruption, the majority of both brokers (62 percent) and developers/owners (53 percent) who took the survey expect those conditions to improve in 2022. Among the nonbelievers in both groups, there is a greater sentiment that supply chain snarls will remain the same rather than worsen in the new year. Of course, there are some dissenters within the ranks.

“The greatest challenge [in 2022] will continue to be supply chain constraints,” wrote Patrick Vaughn, operating director — non-energy at Southern Ute Growth Fund. “But they will improve as businesses adapt and innovation creates new opportunities for those willing to embrace them.”

“Inflation, supply chain issues and labor shortages will likely lead to cap rate decompression,” noted Ben Tapper, senior managing director in the New York City office of Lee & Associates.

“If retail outlets run out of product to sell and people to sell it to, it’s possible they will have to reduce their hours or temporarily close,” he explained. “Additionally, if it takes longer to get the needed materials to make repairs, and tradespeople are less available to conduct the repairs, then properties will fall into disarray.”

In terms of labor shortages, brokers and developers/owners both resoundingly believe that this critical gauge of macroeconomic health and key component of microeconomic overhead costs is likely to improve or stay the same, but not worsen, in 2022.

While the American job market continues to fall short of economists’ expectations, revisions to the monthly jobs reports issued by the U.S. Bureau of Labor Statistics (BLS) are slightly more encouraging. The U.S. economy added about 200,000 new jobs in December, the latest data available at press time. In addition, the national unemployment rate fell by 30 basis points from 4.2 percent to 3.9 percent between November and December 2021, according to the BLS.

While people are unquestionably getting back to work following the termination of key federal stimulus programs, the overall size of the American labor pool is not meeting the needs of employers. According to the BLS, the labor force participation rate stood at 61.9 percent at the end of December, down from the pre-pandemic level of 63.4 percent in February 2020. The U.S. labor market is undersupplied by several million workers and multiple studies have cited fears of contractingCOVID as a major deterrent for employees to return to the workplace.

In some ways, COVID-19 is the common thread that links inflation, supply chain issues and labor shortages. Federal and state relief bills and stimulus payments to businesses and consumers impacted by the virus over the last 22 months pumped large amounts of money into an economy that still featured historically low interest rates. Dock workers at the nation’s largest ports, as well as truck drivers and warehouse workers, have been highly susceptible to virus transmission as essential workers.

Property Type Performances

In addition to chiming in on macroeconomic influences and expected deal volumes, survey respondents were also invited to share expectations on how various commercial asset classes would perform in 2022.

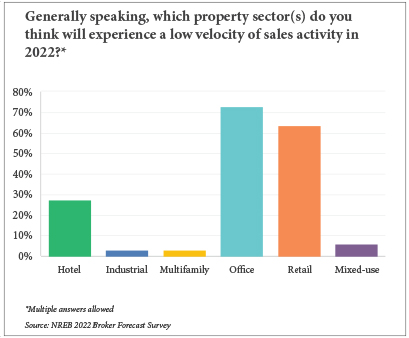

The results of these questions largely mirrored those of recent past surveys and indicated that the impacts that COVID-19 has had on how people work, dine, shop and travel are still very much in effect. Brokers selected industrial and multifamily as the property types that were both most likely to experience a high velocity of sales and to show the greatest increases in valuation this year.

E-commerce activity is likely to soar in the early stages of 2022 following the end of the holiday shopping season and the surge in COVID-19 cases. To that end, nearly 80 percent of developers and owners who completed the survey said that they expect their negotiating power with tenants to be stronger in 2022 than it was in 2021.

E-commerce activity is likely to soar in the early stages of 2022 following the end of the holiday shopping season and the surge in COVID-19 cases. To that end, nearly 80 percent of developers and owners who completed the survey said that they expect their negotiating power with tenants to be stronger in 2022 than it was in 2021.

The bullishness of multifamily has certainly not been hurt by the pandemic and subsequent growth in working from, cooking in and generally staying home. General population growth within both urban cores and the suburban fringes, coupled with a single-family home market defined by scorching prices, will further amplify demand for housing. In an environment where the purchasing power of the average renter has been diminished, this position holds especially true for developments with considerable workforce or affordable housing components.

“With the cost of capital at record breaking lows and rents rapidly growing in several markets in the Northeast, workforce housing in Northeast urban areas will be the largest opportunity for private capital investors,” wrote Aaron Inman, associate at investment sales firm Greysteel.

Heavy speculation continues to swirl around the office sector. The Delta and Omicron variants, both considered highly contagious, forced many users in the Northeast to delay returns to their offices in the fall and winter and to revert to work-from-home/hybrid schedules.

With these occupancy and rent growth concerns in mind, about 72 percent of brokers selected office as the asset class that would likely experience the lowest velocity and volume of sales in 2022. In addition, of the six property types to choose from, office ranked last among broker respondents as the sector that was poised to experience an increase in valuations.

“Coming out of the pandemic with a changing economy and e-commerce driving the industrial market, the challenge will be in the office sector,” wrote Bob Pagani, a senior broker in the Hartford, Conn., office of Colliers. “Seeing what amount of people return to the office and how they actually return will make a difference in office vacancy rates.”

— This article originally appeared in the January/February 2022 issue of Northeast Real Estate Business.