Since the early 2000s, a pattern of shortsighted funding decisions made during fiscal crises has taken its greatest toll on Illinois’ most financially vulnerable institutions and the under-resourced students they serve. The result has been decreased affordability, with Illinois now being among the most expensive states for low-income university students. It has also meant decreased representation of students of color- particularly Black and Latinx students – and a widening gap in degree attainment across racial lines. Presently, the COVID-19 crisis has further exposed the inequities in our higher education system. This report examines how a pattern of disinvestment and underfunding in higher education by our state during past fiscal crises has driven persistent and widening inequities and offers lawmakers a new playbook for making more equity-centered higher education appropriations.

Introduction

Over the last 20 years, state funding declines have made public higher education in Illinois increasingly inequitable. Budget policies that reduced state support for public colleges and universities have effectively disinvested in the education of low-income students and students of color. The result has been post-secondary educational opportunities becoming less accessible and more costly for students historically underrepresented in higher education.

The economic fallout of the COVID-19 pandemic suggests that tough budgetary choices are ahead for Illinois policymakers. If these decisions are not made carefully, low-income students and students of color will be further robbed of the educational opportunities vital to a healthy and productive future. Luckily, there is another path forward. This report will show that there is a way to avoid the mistakes of the past while making fiscally responsible and equitable funding decisions that benefit all of Illinois’ citizens – and how high the stakes are if we don’t get it right.

Section 1 of this report outlines how the recent COVID-19 pandemic threatens to further exacerbate existing inequities in access to higher education. This risk is concentrated at the state’s community colleges and less selective public universities, which are especially vulnerable because of their already razor-thin operating margins and chronic underfunding, and which enroll disproportionately larger numbers of Black, Latinx, and low-income students. In Section 2, we dive into the lessons learned from the two recent recessions and Illinois budget crisis, which suggest that absent the stabilizing influence of additional federal or state aid, public colleges and universities that serve the most disadvantaged students may be forced to raise tuition, cut programs and services for students to balance their budgets, or even have to shut down. Finally, in Section 3, we show why Illinois policymakers must ensure equitable access to post-secondary educational opportunities for all students in the wake of the COVID-19 pandemic, and how they can do so. Policymakers will likely face the unenviable task of reducing overall levels of state spending, but we provide a framework that shows how to distribute state aid equitably, prompting policymakers to:

- Invest in higher education, even in fiscal crises

- Consider the different funding needs of 2-year and 4-year sectors

- Prioritize financially vulnerable students and institutions in allocating funding or cuts to universities

- Ensure funding comes with accountability and transparency

Put simply, low-income, Black, and Latinx students have long been priced out of higher education, and are less able to buffer the financial impacts of the COVID-19 pandemic. If Illinois is going to recover from this crisis equitably, the state must prioritize scarce funding for the institutions that serve them instead of further limiting their educational opportunities.

Section 1

The Effect of the COVID-19 Crisis on Illinois Higher Education

When the COVID-19 crisis struck in March of 2020, it immediately exposed the inequity that underlies higher education in Illinois. While some students hunkered down in relative comfort, the families of low-income students and students of color were more severely impacted. This is true economically, but also in terms of health, as Latinx and Black families in Illinois were 2-3 times more likely to contract the virus, and it has been far more deadly in these communities.[1]

This crisis also showed the critical role colleges and universities play in supporting students. Colleges quickly moved courses online and offered drive-in internet in their parking lots, dispatched hundreds of laptops and mobile hotspots, and sent emergency grants for students’ housing and other needs. Staff personally delivered groceries to food insecure students.[2] Philanthropies mobilized as well, creating an emergency grant fund for the state’s most financially vulnerable students.[3]

Colleges largely retained their students in the move to remote learning in the spring. However, students from low-income families, students of color, and rural students faced distinct challenges, such as difficulty taking classes requiring broadband internet, lacking adequate privacy to participate in classes, and having to balance school with taking care of their families.[4] The pandemic also laid bare the disparities between Illinois’ better-resourced institutions, which mostly reported difficulty with video-conferencing software, and least-resourced institutions, which worked to retain students who were struggling between staying healthy and remaining financially afloat.[5]

It is possible to respond to this crisis in an equitable way, as recent federal and state policies make clear. The federal government passed the CARES Act in March 2020, which distributed about $400 million in emergency grant and institutional funding to Illinois colleges, using a formula that prioritized Pell-eligible students, acknowledging they have many times the financial need of non-Pell-eligible students.[6]

While this formula more equitably distributed resources to those most in need, it could have been improved in a few key ways. By relying on Pell status as a measure of eligibility, undocumented students were unable to receive emergency grant aid. Also, distributing funds based on full-time enrollment underfunded community colleges and public universities that serve large numbers of part-time students (who are more likely to be parents, essential workers, and students of color).[7]

Governor J.B. Pritzker also recognized the importance of funding higher education, designating about half of the $100 million in discretionary funds to public colleges and universities. The Illinois Board of Higher Education (IBHE) then distributed the $45 million in additional federal funds using a formula similar to the CARES Act distribution, but with additional equity considerations.[8] Additionally, IBHE allocated $3 million through a competitive grant program to enroll and retain underrepresented students, and the legislature passed a bill setting up a state emergency grant program.[9] This is a marked change from cuts in past crises, which happened without regard for the needs of vulnerable students and institutions.

Enrollment worsened for summer and fall semesters of 2020, particularly for low-income students. FAFSA completions were down 4% from the start of the pandemic through the summer, which is an early indicator for enrollment declines. This trend was driven by lowincome students, as lower-income high schools decreased their FAFSA completion by 5.3% while at wealthier high schools it increased by 4.9%.[10] This is one of the largest FAFSA completion gaps in the nation by income, and it also indicates disparities by race and rurality.[11] Early fall reports show enrollment is indeed down across many Illinois institutions, particularly among those serving more financially vulnerable students.[12]

If the COVID-19 health threat fades and the economic challenges of a subsequent recession set in, history shows that these enrollment trends may soon reverse. As Section 2 outlines, enrollment typically rises in recessions, particularly at community colleges, and so these institutions, as well as the state’s financial aid program, may face large upticks in applications.[13] How the state prepares for these increases could come to define the future of equity and prosperity in Illinois.

Racial gaps in college affordability were growing long before the pandemic in Illinois, with Latinx students under-represented in bachelor’s degrees conferred, and 11,100 fewer Black students attending college in 2017 than in 2007.[14] The COVID-19 crisis has not struck equally, with nearly a quarter of Black and Latinx families losing their jobs, compared to 15% of White families. Unsurprisingly, surveyed Black and Latinx students were more concerned about their ability to persist in college.[15]

Beyond the ability to cover tuition, there are many barriers to low-income students and students of color returning and persisting through the fall. Many low-income students and students of color are now living with their families, taking on additional caretaking roles, and nearly two-thirds of Latinx and Black students are struggling to meet basic housing and food needs, which will affect student retention.[16] Financial aid is unlikely to cover these impacts, given that the underfunded Monetary Award Program (MAP) can no longer provide sufficient nor guaranteed state aid grants, and COVID-19 may introduce additional complications.[17]

The state of Illinois suffered a $1.1 billion revenue loss because of COVID-19 in fiscal year 2020, and is predicting another $4.6-7.4 billion loss for the next fiscal year.[18] The legislature was still able to pass a budget in May 2020 with level funding for higher education; however, this rare maintenance of funding during an economic crisis was made possible through the legislature’s anticipation of at least $5 billion in revenue from another federal stimulus package, which has yet to materialize.[19] This has created broad uncertainty for institutions about the prospect of funding if another package is not passed. In September, the Governor’s office asked all agencies to prepare for a potential 5-10% cut for the next two years.[20]

Regardless of the outcome of this fiscal year, Illinois will face ongoing budget shortages until the economy has fully recovered from the pandemic, and will likely have to make up this shortfall through strategic cuts; the crucial question now is whether policymakers will build on the immediate response to equitably and adequately support financially vulnerable students and institutions. Section 3 provides a framework for how the state legislature should think through cuts without jeopardizing low-income students and students of color.

Section 2

Recessions, Crises, and Illinois’ Missed Opportunity for Higher Education

Higher education is an investment that pays dividends—and not just for individual students. If Illinois had reached the goal of 60% degree and high-quality credential attainment, which it set in 2015, it would have resulted in an estimated additional $900 million in tax revenue.[21]Instead, a recent Education Trust report gave the state an “F” on both Black and Latinx degree representation among its population.[22] This is the result of a series of funding decisions made in difficult and crucial times over the past two decades.

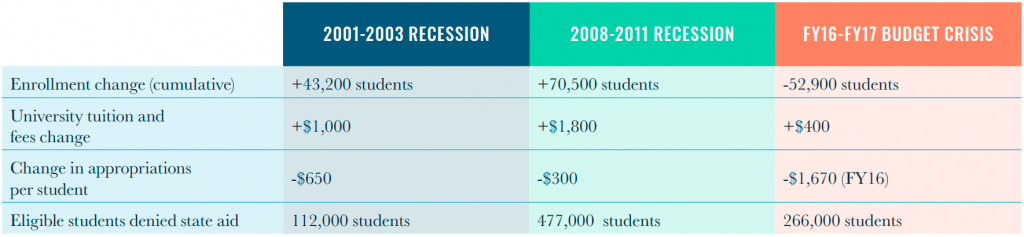

In the recession of the early 2000s and the Great Recession appropriations to colleges and universities plummeted, and these losses were never recovered.[23] Illinois exacerbated this impact with its own self-inflicted budget crisis of fiscal years 2016 and 2017, which had similar, if more concentrated disinvestment and uncertainty. In response to the loss of appropriations during each crisis, selective universities enrolled more out-of-state students and less selective institutions had to increase their prices, restricting access and raising costs for low-income students and students of color.[24] Today, Illinois’ public universities have the fifth most expensive in-state tuition, and some of the highest costs for low-income students in the nation.[25]

Perhaps surprisingly, recessions actually represent a rare opportunity to close equity gaps instead of widening them. There were 63,000 additional Black and Latinx student enrollments in public colleges and universities during the two most recent recessions, drawn by the opportunity that a college degree provides and with less competing prospects in a bad job market.[26]Unfortunately, instead of supporting this growth, policymakers made budget cuts that further shifted costs to students.

This hurt low-income students in under-resourced public colleges and universities the most. With less state aid, more selective universities took in ever-increasing tuition revenue from students who could afford to pay. Meanwhile, institutions serving under-resourced students were not able to backfill with tuition dollars, and the students they serve were least able to bear the costs of a hike in tuition.[27] This dynamic likely contributed to racial disparities in degree completion widening between 2000 and 2016, as research shows greater investment in higher education is needed to support students and combat inequality during recessions.[28] This combination of disinvestment and increased demand for a degree has culminated in a missed opportunity to support students, close completion gaps, and bring equity and productivity to Illinois’ economy.

Heading into the recession of 2001, Illinois was in what many consider to be a golden age of higher education funding. In fiscal year 2002, public colleges and universities received appropriations worth about twice the buying power compared to current budgets, and tuition and fees were half as important for universities’ bottom lines.[29] During this time, the state championed access to financial aid, and Illinois public university students were able to cover 100% of the average tuition and fees with the maximum MAP award in fiscal year 2002, compared to 32% now.[30]

During the early 2000s recession, public higher education enrollment increased by 43,200 students, with 26,700 more Black and Latinx students enrolling—though Black and Latinx students only made up 26% of all Illinois undergraduates in the year 2000, they represented 62% of the enrollment increase from 2001 to 2003.[31] State aid did not rise to match this increase, however. The cumulative number of MAP grants denied to eligible students rose from 5,000 the previous three years to 113,000 between 2001 and 2003.[32] Similarly, per student college and university appropriations fell by 18% in this recession, and would continue to decline nearly every year after that. Meanwhile, the price of public higher education rose precipitously between 2000 and 2003, with tuition increasing 9% at colleges and 23% at universities.[33] Rising costs and falling aid are a recipe for students struggling to persist. This results in more students stopping out and greater debt burdens, and those problems are magnified during recessions.

What if Illinois had invested in higher education appropriations during crises?

Studies show that a 10% decrease in state appropriations results in about a 3% decline in both enrollment and bachelor’s degree graduates.[34] The time periods around both recessions saw drops in appropriations of more than 13%. Thus, if Illinois had maintained its level of investment, and these studies held true, the state would have had over 30,000 additional students enrolled throughout these two recessions, and likely tens of thousands of additional graduates.[35]

The state could have gone further than merely maintaining level appropriations, and ensured that under-resourced universities had the appropriations they needed to avoid increasing tuition. Studies show this would have resulted in thousands of additional students and graduates, and ultimately a more educated and equitable workforce.[36]

By the end of the Great Recession, income inequality between Black and White Illinoisans grew to levels not seen since before the Civil Rights movement. Economists studying this inequality connect it directly to a lack of investment in public higher education.[37] The Great Recession pushed tens of thousands of Illinois students into community college, causing peak public higher education enrollment in the state’s history. Though public university enrollment only increased slightly in this recession, for-profit college enrollment shot up during this time period. Despite far greater costs and questionable value for graduates, studies show that the for-profit sector readily absorbs student population increases when an underfunded public university system isn’t ready to do so, and this may have been the case in Illinois.[38] Rising costs also likely factored into university enrollment stagnation during the recession, and subsequent declines as the economy got better.

The numbers of eligible students denied MAP skyrocketed in the Great Recession; between 2004 and 2007 about 131,000 MAP grants were denied to eligible students and from 2008 to 2011 that number jumped to 477,000.[39] As state aid declines, tuition rises, and that is correlated with students taking on more debt; in Illinois, debt levels rose by $4,300 per student from 2007-2013.[40] Low-income students of color were disproportionately the ones taking on that debt, as state aid was replaced with risky, often co-signed debt that hampered students’ prospects for building generational wealth.[41]

What if Illinois had invested in student aid during crises and recessions?

It is well documented that student aid increases students’ ability to persist; these estimates range from a 3% to 6% increase in retention and on-time completion, with potentially greater effects for students of color.[42] Given that 850,000 MAP grants were denied to eligible students in the years affected by Illinois’ recent crises and recessions alone, this represents a missed opportunity to have tens of thousands of additional college graduates. Having more available grant aid also increases enrollment by about 4% for every $1,000 of additional state aid. Using this estimate, Illinois would have had about 24,000 more student enrollments over the two most recent recessions.[43] Thus, research, Illinois data, and students themselves indicate that if aid still covered public university tuition, and was consistently delivered to eligible students, the state would have far more graduates from low-income households in the workforce now.[44]

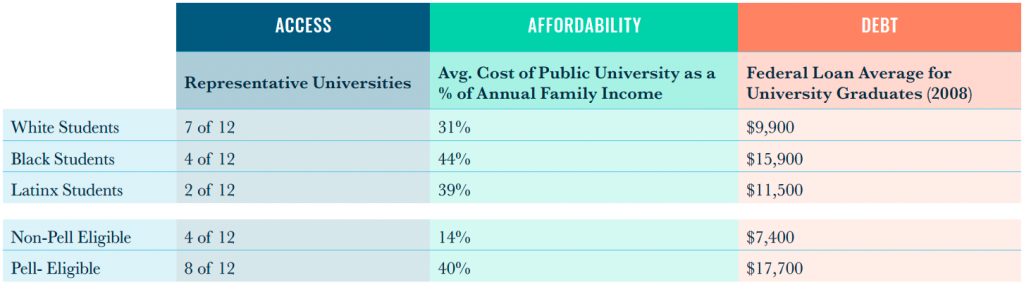

Chart 1

Appropriations have decreased since 2001

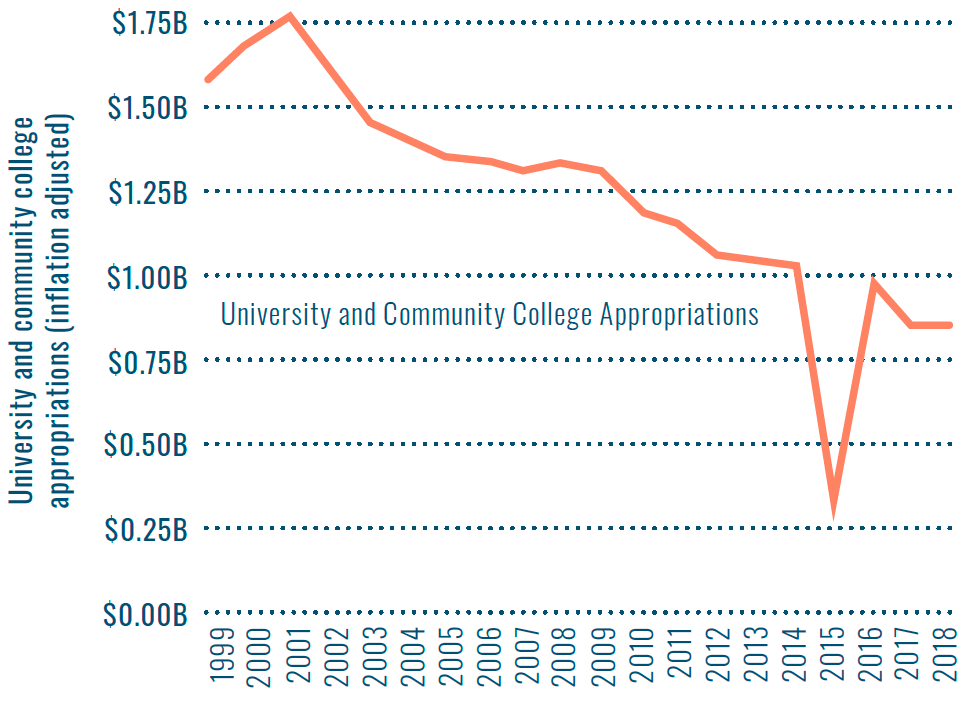

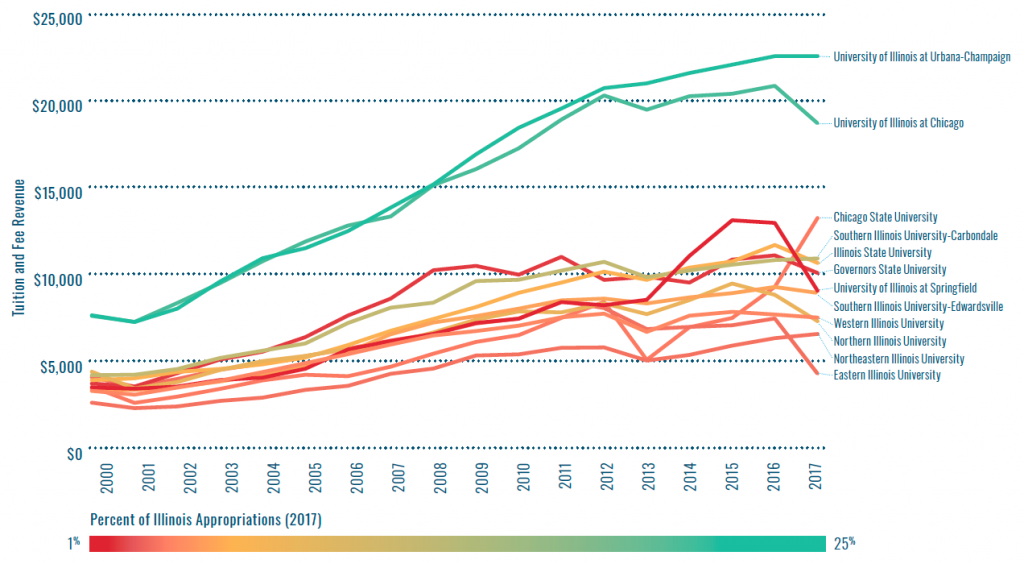

Chart 2

Meanwhile, tuition and fees have increased

Illinois’ budget crisis plunged the state into a recession-like environment for public higher education, despite occurring during an unprecedented period of economic growth across the nation. In one year of this crisis alone the state cut higher education appropriations by more than $2,300 per student, and over the two years of the crisis 52,900 fewer students enrolled in public colleges and universities.[45] As usual, the institutions with less fiscal capacity that enrolled more lower-income students were forced to raise tuition prices. At the six universities that raised tuition the most, the average income of students applying for state aid was $47,000, compared to $75,000 for the six universities that were able to avoid larger tuition increases.[46] This crisis has a lasting legacy, with immeasurable harm done to institutions, a hike in tuition, and long-term equity implications that continue today.

What if Illinois had not defunded higher education during the budget crisis?

These austerity measures were short-sighted: if Illinois had maintained funding for institutions and students instead of plunging the state into a budget crisis, the state economy would have been boosted by $2.3 billion over five years, along with hundreds of millions in additional tax revenue.[47] It’s hard to estimate the full gravity and long-term effects of the budget crisis; studies measuring the effects of incremental increases in appropriations aren’t designed to account for a 72% budget cut in one year, nor the uncertainty of students waiting to hear whether they’ll receive aid from the state, their college, or neither. However, the year before the crisis, one economist estimated that a cut four times smaller than that seen in FY16 could result in about 15,000 fewer students earning bachelor’s degrees and 9,000 fewer associate degrees.[48]

How the state could have benefited from continued investment in recessions and crises

No state lost more public university students than Illinois between the beginning of the Great Recession and now.[49] Media and politicians have decried the loss of students to other states, wondering how to offset the “brain drain.” Evidence suggests, however, that the problem is this repeated disinvestment during crises, pricing students out of the state’s universities—low-income students and students of color most of all.[50] This could also explain why Illinois is now first in the nation in the percentage of undergraduates who choose to attend lower-cost community college, rather than public universities.[51]

This pattern has not been steady or inevitable, but rather, a series of choices. The state launched its Public Agenda for College and Career Success, arguing for the need to close educational gaps by race, income, and region just months before the Great Recession brought historic levels of disinvestment.[52] It renewed calls for reinvestment through the 60 by 25 campaign in 2015, which set the goal of 60% degree and high-quality credential attainment by the year 2025. One year later, the state fell into the worst budget crisis in its history.[53] State financial support for Illinois’ most vulnerable students and institutions is under-discussed in times of crisis, but these are the times when disparities are widened the most.

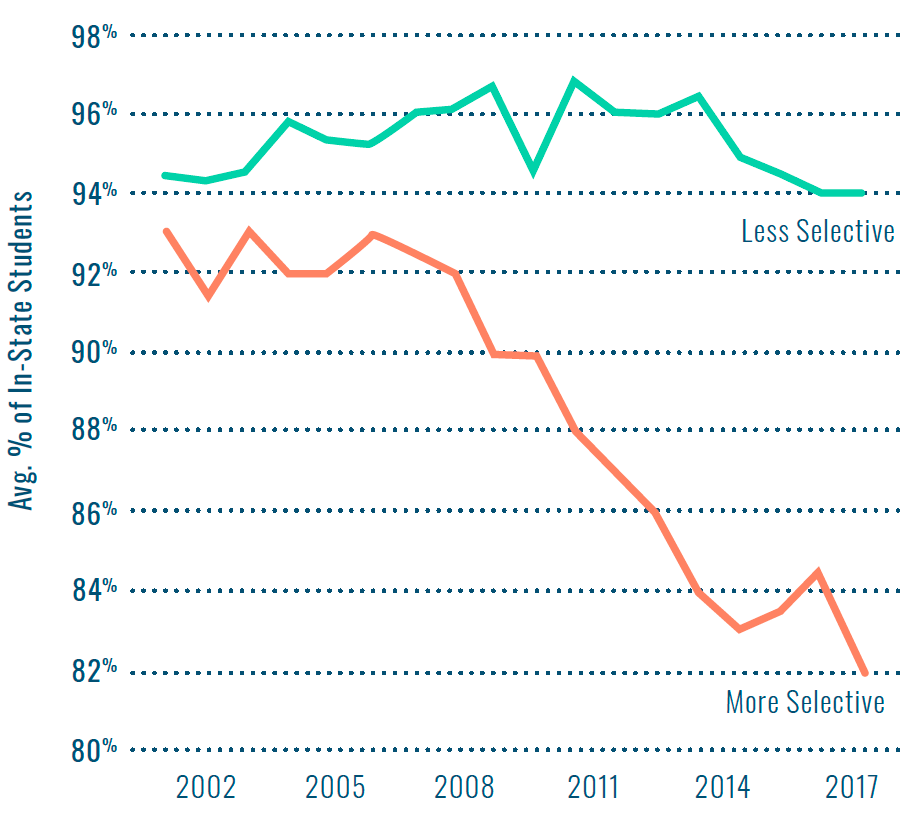

State disinvestment not only changes enrollment at universities, but also affects their composition, as more selective universities often enroll more affluent out-of-state and international students, and fewer low-income students and students of color.[54] With greater investment in recessions, public universities would likely serve more under-represented students from Illinois. How Illinois responds now will determine how the COVID-19 crisis and recession shapes the future of the state.

Chart 3

The percentage of in-state students has declined

at more selective institutions

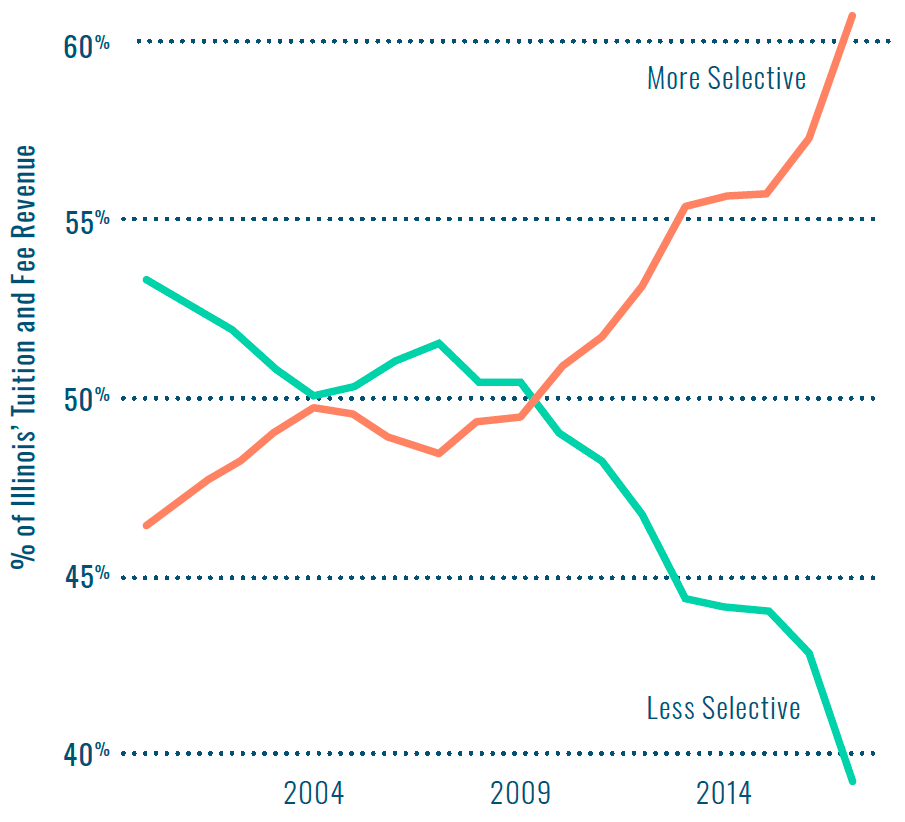

Chart 4

More selective institutions

now receive most of Illinois’ tuition revenue

Analysis of IPEDS data, with more selective universities representing the average of the University of Illinois at Urbana-Champaign (UIUC) and the University of Illinois at Chicago (UIC), and less-selective universities representing the average of Illinois’ other 10 universities.[56] UIUC drove the decrease of in-state students at more selective universities, as their share of in-state students decreased by 16 percentage points over this time, whereas UIC’s share decreased by 6 percentage points. However, the other 10 universities averaged only a 1 percentage point decrease.

Current inequities in Illinois higher education

Disinvestment, particularly in past recessions, combined with inequitably distributed state funding, has fueled disparities in affordability and access. This means that though under-represented students need an influx of resources to attend college in the COVID-19 pandemic, they are more likely to be enrolled in an institution that will struggle to increase supports, or to even survive the crisis.

Low-income students and students of color in Illinois are more likely to attend community colleges than public universities, especially in economic crises.[57] Even in good economic times, this sector receives a fraction of the funding per student compared to four-year universities, despite community college students averaging less in income. This is in part due to underfunding. The Illinois Community College Board (ICCB) distributes funding to colleges based on two formulas, one of which offsets costs and the other which equalizes revenues across institutions. Underfunding warps those formulas to become less equitable, and they have been under-funded for years: in FY2020 community colleges needed about $900 million from the state, but received only $250 million in funding.

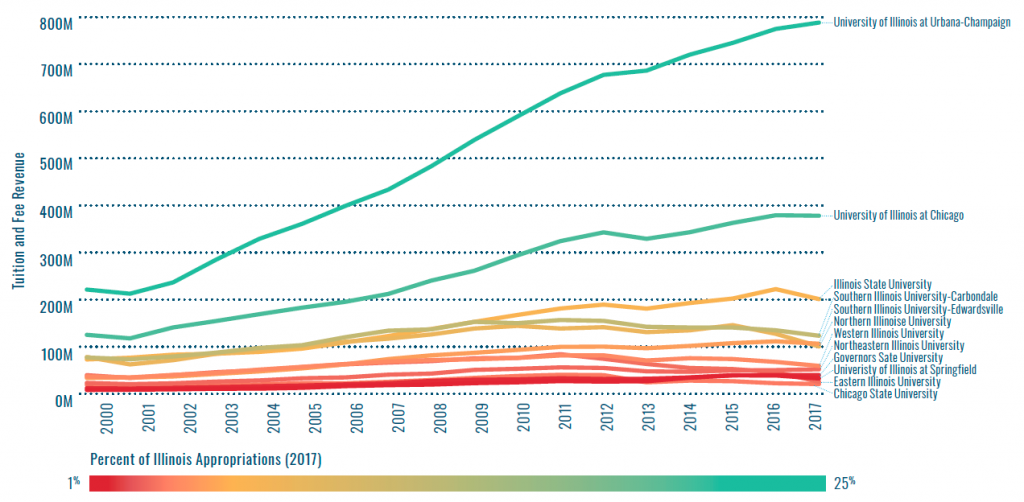

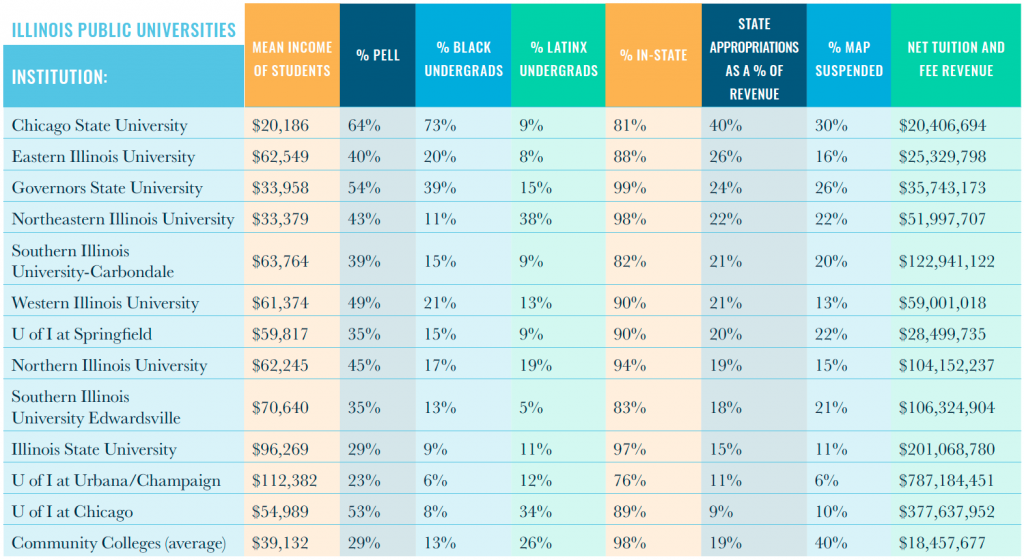

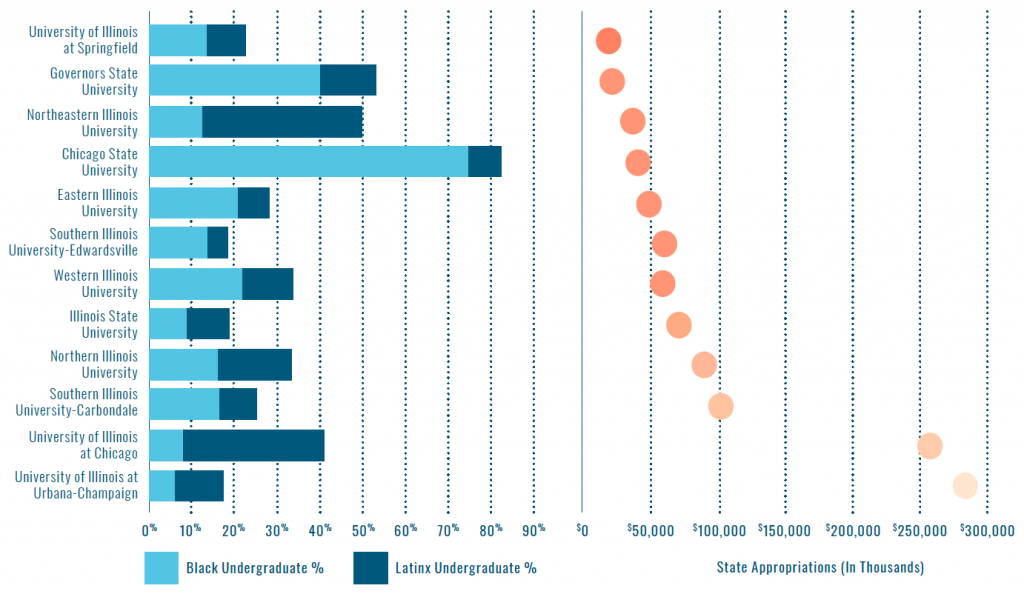

Among public universities, better-resourced institutions are providing less access to Black, Latinx, and low-income students. These institutions have a greater ability to weather the crisis not only because they receive more in appropriations, tuition, and endowments, but also because they are less reliant on state funds.[58] For example, $600 million of Illinois’ $1.15 billion budget for public universities goes to its two more selective institutions, which enroll only 6% and 8% Black students, respectively. However, these two universities are the least reliant on state funding.[59]

Section 2 Conclusion: Illinois’ Missed Opportunity

Illinois could be far less unequal and more productive if the state had maintained funding in tough economic times, but even equitable cuts could have narrowed racial gaps and boosted economic productivity. As Illinois shrank its higher education budget, the two institutions receiving the bulk of appropriations enrolled more out-of-state and international students, and became less representative of Illinois’ Black and Latinx population.[60] If the state had shifted appropriations instead of making level cuts, the universities serving more low-income students and students of color likely could have kept costs lower, enrolled more students, and better served them. Further, funding universities has its own impact on their surrounding communities—for example, the state lost out on $950 million of higher education-related economic output during the budget impasse alone, and about half of that would have been outside of the Chicago area.[61]

It’s hard to overstate the effects of these actions. An associate degree means $300,000 more in average lifetime income and a bachelor’s degree translates to an additional $600,000, compared to a high school diploma.[62] On a societal level, it would mean decreases in inequality and unemployment, better health for graduates and their families, and demonstrable improvements to democracy, political stability, and human rights.[63]

Chart 5

More selective universities have received a greater share of appropriations even as their tuition revenue grew

Chart 6

Section 3

A Framework for Making Equitable Higher Education Funding Decisions

Higher education is a transformative force for social mobility, boosting individual lifetime earnings, strengthening communities, and improving the productivity of Illinois’ workforce. Its importance is heightened for historically disadvantaged and marginalized groups. Yet, as described in Sections 1 and 2, equitable, affordable access to public higher education for all Illinoisans remains elusive. And now, the effects of the COVID-19 pandemic threaten to worsen the state’s systemic inequities in college access and completion.

However, it is not too late for Illinois to reverse this course and adopt a new policymaking framework that puts equity in public higher education at the forefront.

An equitable funding system provides sufficient resources to ensure every student has access to equal educational opportunities regardless of personal characteristics, background, geographic location, or college. Ensuring equal opportunity, however, does not mean that state funding or budget cuts should be divided equally, or solely according to last year’s appropriations. That approach has priced out many students from the vulnerable institutions that intended to serve them, and has contributed to the state’s declining enrollment over the last decade. Instead, resources should be differentiated by institution according to student need and institutions’ capacity to raise revenue through tuition and fees. State funding should then serve as a necessary equalizer that prevents institutions from inequitably passing costs on to students.

State policymakers and the courts are helping close gaps in opportunities for K-12 education with fair funding systems that explicitly account for differences in educational costs across districts and schools. Nearly all states, and most recently Illinois, use formulas that determine state aid based on disparities in student need, the cost of education, and local communities’ tax capacity. This ensures all schools have the resources they need for students to learn. Section 1 outlines how the federal and state government have started to follow this lead in the higher education response to the COVID-19 pandemic. It is essential that state policymakers do the same for upcoming budget cycles.

A framework for applying equity to upcoming budget decisions

Legislators will face difficult budget decisions in the upcoming years. Realizing equity goals, including lessening the impact of COVID-19 and establishing an equitable recovery, will require Illinois’ policymakers to carefully consider how available funds or cuts are distributed. To do this, legislators should:

Illinois’ state policymakers must chart a new course for allocating state funds for students, colleges, and universities. Due to budget cuts over the last 18 years, state funding for public higher education in Illinois has become increasingly inequitable. These cuts have translated to about 1.7 million MAP grants being denied to eligible students. For appropriations, the result has been a steady increase in tuition and fees, making Illinois’ public universities among the most expensive in the country. As potential undergraduates get priced out, enrollment declines, particularly for students of color, low-income students, and students from rural communities.[64]

The pandemic and subsequent recession means that over the next few years policymakers will likely face the unenviable task of reducing overall levels of state spending. However, in order to protect the future of Illinois, and the lifetime opportunities of its residents, the state must do its best to limit cuts to higher education. Section 2 shows that doing so would have produced tens of thousands of more graduates and a more equitable and recession-resistant workforce.[65] It is clear that Illinois’ future depends on the support it gives to students throughout this crisis. Early indicators of enrollment loss are troubling, but it’s not too late to turn this picture around. By continuing to invest in the MAP program and in the worst-case scenario, limiting cuts to community colleges’ and universities’ appropriations to what they can sustain while adequately serving students, the state can use this recession to build the equity and capacity of its workforce, rather than undercutting it.

In the face of overall reductions in state funding for higher education, fair cuts require policymakers to take enrollment across the sectors into account as well as differences in student need. Institutions with greater financial capacity can better buffer the effects of cuts on students, particularly those most at risk of not accessing or completing a college degree. The community colleges that educate larger shares of low-income students and students of color already have razor-thin margins and have been subject to chronic underfunding, making them especially vulnerable in the pandemic. Students attending these open-access two-year institutions are more likely to require additional supports compared to their peers at four-year institutions.[66] Thus, legislators should consider splitting available funds for 2- and 4-year institutions according to the distribution of student need, and cost factors, between the sectors. In the longer term, community college funding should be sufficient to offset costs, through the base operating grant formula, while making up for disparities in local funding, through equalization grants.

Unlike state funding for two-year colleges, there is no systematic formula for allocating state operating support among Illinois’ public four-year institutions. Past state cuts have largely been allocated across-the-board as a percentage of base funding level. Instead, legislators can and should explicitly account for differences in student need and long-standing inequities in educational resources across institutions—including not only the numbers of students historically underrepresented in higher education but also an institution’s concentration of low-income, Black, and Latinx students.

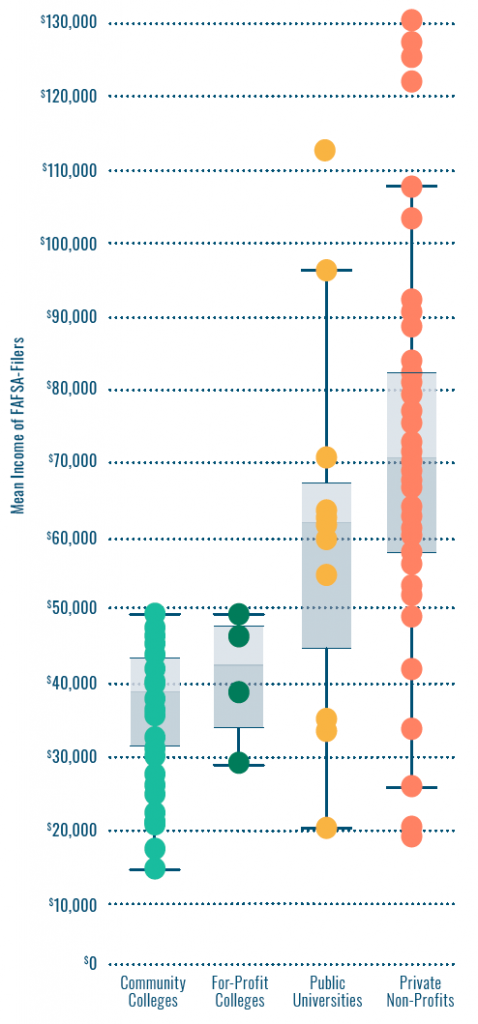

Income and college access go hand-in-hand in Illinois, as lower-income Illinoisans are far less likely to go to college.[67] There are stark income gaps by and within sector, as the average community college MAP applicant has $22,000 less in family income than the average public university applicant.[68] Equitable funding should close affordability gaps, so that low-income students don’t need to go deep into debt to access the same college opportunities.

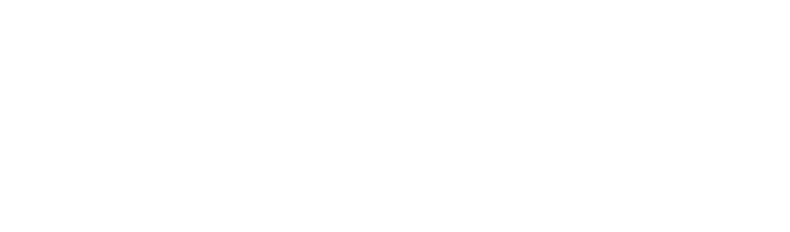

Table 3

The state should also ensure institutions plan on equitably serving undocumented students and rural students, two student populations that face challenges in the COVID-19 pandemic, but may be harder to account for due to data and privacy concerns.

Systemic barriers and significant racial wealth gaps, built over centuries of discrimination, limit the opportunities that Black and Latinx families have had to earn income, build wealth, and gain access to four-year colleges. As universities chase tuition dollars to make up for falling appropriations, they have failed to enroll representative numbers of students of color: only 4 of 12 universities are representative of the state’s population of Black young adults, and only 2 of 12 reflect the percentage of Latinx Illinoisans. Students of color who do gain access still pay greater percentages of their family income and take out more debt to attend.[69] Research shows that the best way to make progress is to directly acknowledge and address racial disparities in policymaking.[70]

Despite having the fifth largest number of undocumented students in higher education in the country, Illinois had shown limited commitment to investing in their success until the 2019 RISE Act, which gives access to need-based financial aid to Illinois’ undocumented students.[71] The continued lack of access to federal funding and loans is a barrier to college completion, pushing undocumented students to choose between predatory private loan options or forgoing higher education. Immigration status also makes students ineligible for resources to cover basic needs, like the Supplemental Nutrition Assistance Program (SNAP) and emergency relief provided by the CARES Act.[72]

Living in rural Illinois creates unique barriers to higher education. Rural students’ access can be limited by the long distances they travel to attend four-year institutions, and as a whole, rural students enroll in community college at higher rates than urban students and transfer less.[73] Rural students who do attend four-year universities tend to be higher income than those in community college, and they still take on levels of debt that can push them to stay in more metropolitan areas. This ultimately may hurt the economies of smaller Illinois communities, who would benefit from a larger, better-educated workforce.[74]

Chart 7

Income of FAFSA-filing students, by sector

Past experience, both in Illinois and other states, indicates that across-the-board cuts ultimately harm less-selective and open-access institutions. While this approach may seem “fair” on the surface, it ignores the stark differences across institutions in both the extent of student need and their ability to offset state budget cuts by shifting existing or raising new revenues. For institutions serving larger shares of the state’s low-income, Black, Latinx, and rural students, mitigating disinvestment by raising undergraduate tuition and fees presents an existential threat to their ability to serve students and their viability. Universities consolidating or shuttering would cut off access to thousands of the state’s most vulnerable students during a time when they need support the most (see chart 8 and 9).

Thus, it is critical that state policymakers adopt a new framework for allocating state aid to public universities that explicitly accounts for differences in fiscal capacity. During the upcoming budget cycle, additions or reductions in appropriations to the state’s higher education institutions should account for an institution’s financial circumstances, such as reliance on state aid to stabilize institutional revenues in lieu of undergraduate tuition and fees. This is not unlike approaches used to equalize aid for K-12 education across localities, which adjusts for institutions’ capacity to raise revenues.[75]

Substantial, equitable investment in higher education does not need to come at the expense of accountability. On the contrary, the legislature should make institutions responsible for spending state funding equitably on their students, prioritizing Illinois’ under-resourced students in distributing institutional aid and student supports. The first step toward accountability is transparency in reporting, and the state should require and facilitate thorough and uniform data collection, disaggregated by race and income, reported annually and available to the public.

Chart 8

Universities serving greater percentages of Black and Latinx students are more reliant on state funding

Chart 9

Universities receiving more in appropriations serve fewer Black and Latinx students

Other considerations for equitable distribution

Prioritizing need-based aid over merit-based aid

In a lean spending environment, policymakers are often asked to decide between allocating funding based on need and based on merit. Though some laud merit-based funding for focusing resources on those more likely to succeed, labeling students as worthy or undeserving of funding based on measures of academic success is problematic from an equity standpoint. For example, many merit funding judgments are based on standardized tests, which studies show to be more correlated with wealth and race than predictive of college success.[76] Merit aid distributes already scarce resources away from students who need it most, especially during a time of budget cuts.

Promoting efficiency by subsidizing degrees for teachers and nurses

Illinois is facing a shortage of teachers and nurses, two essential and recession-resistant professions.[77] Illinois has been cutting investment in teacher preparation, making these programs less affordable, which has occurred alongside a 40% decrease in teacher preparation enrollees from 2011-2017.[78] Our state now sees a major shortage of teachers: for every bachelor’s degree conferred in early childhood education there are 6.5 projected vacancies.[79] Disinvestment in targeted financial aid programs like the Minority Teachers of Illinois Scholarship further reduces support for teacher candidates of color, inhibiting Illinois’ ability to improve the diversity of Illinois’ teacher workforce. Similarly, a lack of equitable investment in nursing programs may contribute to them being under-representative of Black and Latinx students.[80]

In its push for a more educated workforce, Illinois should prioritize these professions, and do so in a way that promotes equity. It is in the best interest of the state and students to increase the equitable subsidies that encourage students to pursue these degrees, as it will result in economic benefits and more teachers and nurses.

Structural pension costs

The state must address its pension costs, which have monopolized a growing share of higher education appropriations, to an extent that is unique to Illinois.[81]Though it is beyond the scope of this report to propose solutions, any solution must minimize the competition of funds allocated among pensions, institutions, and students.[82]

Moving forward, there is a critical need to craft a funding formula that can help Illinois achieve the kind of lasting, systemic improvement needed to achieve its degree attainment targets while closing its equity gaps. The proposed framework for reallocating funding in the current budget cycle is also a starting point for accomplishing these goals. However, it will take years to develop an objective, transparent, and predictable system for funding public higher education in Illinois and the time to start is now. As previous recessions have shown, if the state waits until it has pulled itself out of the COVID-19 crisis it will be too late. The state must convene an independently led, equity-focused task force to devise this funding formula in conjunction with the Illinois Board of Higher Education’s upcoming strategic plan.

Critical questions for legislators devising a longer-term funding formula:

- What is an adequate amount to make sure every student is supported in enrolling, persisting, and completing college?[83]

- How should funding be allocated among the state’s two- and four-year public colleges and universities, according to differences in student need and education costs?

- How can funding structures incentivize betterresourced universities to serve student populations that reflect Illinois in terms of race and income?

- How can state funding serve as an equalizer among institutions with different capacities to raise revenue through student tuition and fees?

Conclusion

The forward momentum that Illinois higher education was experiencing prior to the emergence of COVID-19 need not become a distant memory. Instead, it should be a foundation upon which Illinois can build a more equitable path for the state’s students. In 2017, by enacting its Evidence Based Funding Formula, Illinois recognized a simple truth in education: those who have the least often need the most help. The application of this simple idea to students in higher education is long overdue. The stakes are too high for Illinois to continue on its current course, which often results in students with the least economic resources attending similarly disadvantaged colleges and universities. Not long ago, Illinois was a national leader in prioritizing equitable access to the state’s public institutions. With the onset of COVID-19 and its disparate impact on Black and brown communities, now is the time for Illinois to reclaim its status as a national leader in higher education access.

References

1. Illinois Department of Public Health. “COVID-19 Statistics.” Accessed October 5, 2020. https://www.dph.illinois.gov/covid19/covid19-statistics.

2. Castillo Richmond, Lisa. “No Matter Where You Are, Illinois Colleges & Universities Matter.” Partnership for College Completion. Accessed September 20, 2020. https://partnershipfcc.org/blog/ no-matter-where-you-are-illinois-colleges-universities-matter.

3. Hahn, Melissa, Lynn Baker, and Matt Berry. “Illinois Higher Education Emergency Fund Raises $550k.” Illinois Board of Higher Education, April 18, 2020. http://www.ibhe.org/pdf/2020.04.18_Higher_Ed_ Emergency_Fund_Release.pdf.; Illinois Community College Board.

4. Fischer, Karin. “When Coronavirus Closes Colleges, Some Students Lose Hot Meals, Health Care, and a Place to Sleep.” The Chronicle of Higher Education, March 11, 2020. https://www.chronicle.com/article/ when-coronavirus-closes-colleges-some-students-lose-hot-meals-health-care-and-a-place-to-sleep/.; Weissman, Sara. “How Will the Coronavirus Impact Enrollment For Rural Students?” Diverse, April 14, 2020. https://diverseeducation.com/article/173388/.

5. Partnership for College Completion. “Webinar: COVID-19 Impacts on Entering College Freshmen in 2020.” April 7, 2020.

6. Pelosi, Nancy, and Kevin McCarthy. “Higher Education Fourth Supplemental Letter,” April 9, 2020. https://www.acenet.edu/Documents/Letter-House-Higher-Ed-Supplemental-Request-040920.pdf.

7. Miller, Ben. “A Better Formula for Higher Education’s Federal Coronavirus Funding.” Center for American Progress, May 11, 2020. https://www.americanprogress.org/issues/education-postsecondary/ reports/2020/05/11/484838/better-formula-higher-educations-federal-coronavirus-funding/. 8“Governor’s Emergency Education Relief Fund.” Accessed September 20, 2020. https://www.ibhe.

8. “Governor’s Emergency Education Relief Fund.” Accessed September 20, 2020. https://www.ibhe.org/Geer-Grant-RFP.html.; Additional information provided by IBHE.

9. Illinois Board of Higher Education. “Governor’s Emergency Education Relief Fund.” Accessed September 20, 2020. https://www.ibhe.org/Geer-Grant-RFP.html. “Governor’s Emergency Education Relief Fund.”

10. DeBaun, Bill. “COVID-19 and FAFSA Completion.” Tableau Public. Accessed September 20, 2020. https://public.tableau.com/profile/bill.debaun.national.college.access.network#!/vizhome/COVID- 19andFAFSACompletion/COVID-19FAFSA. This increase may be related to new Illinois legislation requiring high school students to complete the FAFSA.

11. Ibid; KIDS COUNT Data Center. “Children in Title I Schools by Race and Ethnicity,” December 2018. Title I eligible schools are overrepresentative of Black and Latinx students. https://datacenter.kidscount.org/ data/tables/8418-children-in-title-i-schools-by-race-and-ethnicity?loc=1&loct=1.; Illinois Report Card. “Illinois Report Card: Racial/Ethnic Diversity.” Accessed September 20, 2020. https://www.illinoisreportcard. com/state.aspx?stateid=IL&source=studentcharacteristics&source2=studentdemographics.

12. McGee, Kate. “Did Students Show Up? 6 Takeaways From Illinois’ Fall College Enrollment Numbers.” WBEZ Chicago, September 14, 2020. https://www.wbez.org/stories/ did-students-show-up-6-takeaways-from-illinois-fall-college-enrollment-numbers/13b3e60b-1e14-4639-9d0d-46794ea6bbb0.

13. Merriman, David, Jennifer Delaney, and Robin Fretwell Wilson. “Illinois Higher Education Enrollments During Recessions.” University of Illinois, April 30, 2020. https://igpa.uillinois.edu/sites/igpa.uillinois.edu/files/reports/Illinois%20Higher%20Education%20Enrollments%20During%20Recessions_Report-final0.pdf.

14. Abrahamson, Mike. “College Affordability for Students in Illinois: On Illinois’ Disinvestment In Higher Education & What Can Be Done About It.” Partnership for College Completion, October 6, 2019. https:// partnershipfcc.org/affordability.

15. Fain, Paul. “Higher Education and Work Amid Crisis.” 6/17/2020. Inside Higher Ed. Accessed September 20, 2020. https://insidehighered.com/news/2020/06/17/ pandemic-has-worsened-equity-gaps-higher-education-and-work.

16. Goldrick-Rab, Sara, Vanessa Coca, Gregory Kienzl, Carrie R. Welton, Sonja Dahl, and Sarah Magnelia. “New Evidence On Basic Needs Insecurity And Student Well-Being.” #Realcollege During the Pandemic. The Hope Center, June 2020. https://hope4college.com/wp-content/uploads/2020/06/Hopecenter_RealCollegeDuringthePandemic.pdf.

17. Financial aid distribution takes into consideration tax return numbers from the previous year—a far cry from where families may be financially during the COVID-19 crisis.

18. Vinicky, Amanda. “How COVID-19 Has Affected Spending, Revenues in Illinois.” WTTW News, July 6, 2020. https://news.wttw.com/2020/07/06/how-covid-19-has-affected-spending-revenues-illinois.; NBC Chicago. “Pritzker: COVID-19 to Cause Projected $7 Billion Revenue Shortfall Over Next 2 Fiscal Years,” April 15, 2020. https://www.nbcchicago.com/news/coronavirus/ pritzker-covid-19-to-cause-projected-7-billion-revenue-shortfall-over-next-2-fiscal-years/2256436/.

19. Hancock, Peter. “Illinois Lawmakers Eying $41 Billion Budget with $5 Billion in Borrowing.” The Southern Illinoisan, May 22, 2020.https://thesouthern.com/news/local/govt-and-politics/illinois-lawmakerseying- 41-billion-budget-with-5-billion-in-borrowing/article_ee5815fb-b34e-5691-be1f-24e6863586bf.html.

20. Nowicki, Jerry. “Pritzker Instructs Agency Leaders to Prepare for Cuts of 5-10%.” Herald&Review, September 16, 2020.https://herald-review.com/news/state-and-regional/govt-and-politics/pritzker-instructsagency- leaders-to-prepare-for-cuts-of-5-10/article_5c49a062-5f95-543a-846d-9433af8bfd60.html.

21. “Fiscal Year 2019 Higher Education Budget Recommendations.” Illinois Board of Higher Education, February 2018. http://legacy.ibhe.org/Fiscal%20Affairs/PDF/FY19BudgetBook.pdf.

22. The Education Trust. “State Equity Report Card: Illinois.” Accessed September 20, 2020. https://www.stateequity.org/state/illinois.

23. Anderson, Robert E. “Coronavirus and State Support of Higher Education.” SHEF Editorial. SHEEO, n.d. https://shef.sheeo.org/wp-content/uploads/2020/04/SHEEO_SHEF_FY19_Editorial.pdf.

24. Allen, Drew, and Gregory C. Wolniak. “Exploring the Effects of Tuition Increases on Racial/Ethnic Diversity at Public Colleges and Universities.” Research in Higher Education 60, no. 1 (February 1, 2019): 18–43. https://doi.org/10.1007/s11162-018-9502-6. See partnershipfcc.org/framework for an interactive visualization of relevant Illinois data.

25. “Tuition and Fees by State: Public Four-Year.” Trends in College Pricing 2019. College Board, n.d. https://research.collegeboard.org/pdf/2019-trendsincp-fig-6.pdf.; Abrahamson, “College Affordability for Students in Illinois: On Illinois’ Disinvestment In Higher Education & What Can Be Done About It.”

26. Illinois Board of Higher Education. “Chapter I & Table I-2,” 2019. http://www.ibhe.org/ibhedatabook/ChapterI/Table%20I-2.aspx.

27. The definition of “more-selective universities” and “less-selective universities” used throughout this report comes from the Education Trust’s Segregation Forever report, which analyzes the country’s 101 most selective public colleges and universities. Nichols, Andrew Howard. “Segregation Forever?” The Education Trust (blog). Accessed October 26, 2020. https://edtrust.org/resource/segregation-forever/.

28. “State Equity Report Card: Illinois.”; “Better Together: How a Reimagined Federal-State Partnership to Fund Public Higher Ed Could Help Bring College Within Reach for All.” The Institute for College Access & Success, October 2019. https://ticas.org/wp-content/uploads/2019/10/Better-Together.pdf.

29. “Fiscal Year 2019 Higher Education Budget Recommendations.”; Illinois Board of Higher Education. “Examining the Relationship between State Appropriation Support and Tuition and Fees at Illinois Public Universities,” June 2018. https://www.ibhe.org/DataPoints/Shift-to-Tuition-and-Fees-from-State-Appropriations-June-2018.htm. With more adequate state support, tuition and fees only had to cover 28% of a university’s budget, compared to 62% in 2017.

30. “Fiscal Year 2020 Higher Education Budget Recommendations.” Illinois Board of Higher Education, December 2018. https://www.ibhe.org/assets/files/FY20_Budget_Book.pdf. Illinois was also one of the first states to provide state financial aid to part-time and non-traditional students.

31. “Chapter I & Table I-2.” This compares academic year 2003 to 2001, looking at undergraduate student enrollment

32. “Table 2.0d of the 2019 ISAC Data Book.” Illinois Student Assistance Commission, n.d. https://www.isac.org/e-library/research-policy-analysis/data-book/documents/2019-Data-Book/2019DBTable2.0d-pdf.pdf.

33. “Fiscal Year 2015 Higher Education Budget Recommendations.” Illinois Board of Higher Education, February 2014. https://www.ibhe.org/pdf/FY15BudgetBook.pdf.

34. Goodman, Sarena, and Alice Henriques Volz. “Attendance Spillovers between Public and For-Profit Colleges: Evidence from Statewide Changes in Appropriations for Higher Education.” SSRN Scholarly Paper. Rochester, NY: Social Science Research Network, October 1, 2015. https://doi.org/10.2139/ssrn.2602897.; Merriman, Delaney, and Fretwell Wilson, “Illinois Higher Education Enrollments During Recessions.”

35. Ibid. This calculation applied the 3% estimated effect to the decline in appropriations relative to a base year before the recession, estimating a cumulative increase in enrollment for the years affected by the 2000s recessions.

36. Manzo IV, Frank. “The History of Economic Inequality in Illinois: 1850-2014.” Illinois Economic Policy Institute, March 4, 2016. https://illinoisepi.org/site/wp-content/themes/hollow/docs/wages-laborstandards/ The-History-of-Economic-Inequality-in-Illinois-FINAL.pdf.

37. Ibid.

38. ”Goodman and Volz, “Attendance Spillovers between Public and For-Profit Colleges: Evidence from Statewide Variation in Appropriations for Higher Education.”

39. “Table 2.0d of the 2019 ISAC Data Book.”

40. Goodman and Henriques Volz, “Attendance Spillovers between Public and For-Profit Colleges.”; Mitchell, Michael, Michael Leachman, and Kathleen Masterson. “Funding Down, Tuition Up.” Center on Budget and Policy Priorities, May 18, 2016. https://www.cbpp.org/research/state-budget-and-tax/funding-down-tuition-up.

41. Fishman, Rachel. “The Wealth Gap PLUS Debt.” New America, May 18, 2020. http://newamerica.org/education-policy/reports/wealth-gap-plus-debt/.

42. Deming, David, and Susan Dynarski. College Aid. NBER Book Chapter Series, no. c11730. Cambridge, Mass: National Bureau of Economic Research, 2010.

43. Dynarski, Susan M. “Does Aid Matter? Measuring the Effect of Student Aid on College Attendance and Completion.” Working Paper. Working Paper Series. National Bureau of Economic Research, November 1999. https://doi.org/10.3386/w7422. This study estimates a 3.6% effect, which is used in the calculation here. Similarly, a 4% effect is found in Kane, Thomas J. A Quasi-Experimental Estimate of the Impact of Financial Aid on College-Going. NBER Working Paper Series, no. w9703. Cambridge, Mass: National Bureau of Economic Research, 2003.

44. “FY17 ISAC Grant Survey: How Are Colleges and Universities Handling MAP during the Budget Delay?” ISAC Research Brief. Illinois Student Assistance Commission, December 2016.

45. Calculated using data from IBHE budget and data books, comparing academic year 2015 and 2016 to the base year of 2014.

46. Manzo IV, Frank, and Robert Bruno. “Understanding the Costs of the Recent Budget Impasse in Illinois.” High-Impact Higher Education. Illinois Economic Policy Institute, September 6, 2017. https://illinoisepi. files.wordpress.com/2017/09/ilepi-pmcr-high-impact-higher-education.pdf.

47. McMahon, Walter W. “Higher Education Budget Issues: Do the Benefits Warrant the Costs? What Are the Options?” IGPA Toolbox, January 11, 2014. https://uofi.app.box.com/s/wo76gs4reryzdn4epgae/file/15588083106.

48. Ibid.

49. College Board. “Trends in College Pricing Resource Library,” May 31, 2019. https://research.collegeboard.org/trends/college-pricing/resource-library.

50. Abrahamson, “College Affordability for Students in Illinois: On Illinois’ Disinvestment In Higher Education & What Can Be Done About It.”; Allen and Wolniak, “Exploring the Effects of Tuition Increases on Racial/Ethnic Diversity at Public Colleges and Universities.”

51. “Trends in College Pricing Resource Library.”

52. “The Illinois Public Agenda for College and Career Success.” Public Agenda Task Force, 71 2009. https://www.ibhe.org/assets/files/070109_PublicAgenda.pdf.

53. Stewart, Brook. “Illinois Board of Higher Education Affordability Action Team White Paper: Enhancing College Affordability in Illinois.” Affordability Action Team, December 2015. https://www.ibhe.org/pdf/ affordabilitywhitepaper2015.pdf.

54. Jaquette, Ozan. “State University No More: Out-of-State Enrollment and the Growing Exclusion of High-Achieving, Low-Income Students at Public Flagship Universities.” Jack Kent Cooke Foundation, May 2017. https://www.jkcf.org/research/state-university-no-more-out-of-state-enrollment-and-the-growing-exclusion-of-high-achieving-low-income-students-at-public-flagship-universities/

55. Center on Budget and Policy Priorities. “Chart Book: The Legacy of the Great Recession,” August 5, 2010. https://www.cbpp.org/research/economy/chart-book-the-legacy-of-the-great-recession. In the early 2000s recession, the unemployment rate did not return to pre-recession levels until the beginning of 2004. In the Great Recession, jobs were not being consistently added until March of 2010. This report uses 2011 as the last academic year affected by the recession because the unemployment rate fell throughout AY 2012 to levels typical of post-recession periods, though it is possible that AY2012 and AY 2013 were both affected by the recession, as well.

56. More-selective and less-selective universities as defined by the Education Trust’s Segregation Forever reports. Chart 4 uses IPEDS data on students paying the in-state tuition rates, as that variable is available through the year 2000.

57. Abrahamson, “College Affordability for Students in Illinois: On Illinois’ Disinvestment In Higher Education & What Can Be Done About It.”

58. Data analysis from Urban Institute. “Education Data Explorer,” 2019. https://urbn.is/eddata.

59. Ibid.

60. “Chapter I & Table I-2.”; Mitchell, Michael, Michael Leachman, and Kathleen Masterson. “A Lost Decade in Higher Education Funding.” Center on Budget and Policy Priorities, August 22, 2017. https://www. cbpp.org/research/state-budget-and-tax/a-lost-decade-in-higher-education-funding.

61. Manzo IV and Bruno, “Understanding the Costs of the Recent Budget Impasse in Illinois.”

62. The Hamilton Project. “Lifetime Earnings by Degree Type,” April 26, 2017. https://www.hamiltonproject.org/charts/lifetime_earnings_by_degree_type?_ga=2.209777296.481249648.1595872360-1544677060.1589901132.

63. McMahon, “Higher Education Budget Issues: Do the Benefits Warrant the Costs? What Are the Options?”; Hershbein, Brad, Melissa S. Kearney, and Lawrence H. Summers,. “Increasing Education: What It Will and Will Not Do for Earnings and Earnings Inequality.” Brookings (blog), March 31, 2015. https://www.brookings.edu/blog/up-front/2015/03/31/increasing-education-what-it-will-and-will-not-do-for-earnings-and-earnings-inequality/. For example, Increasing Black bachelor’s degree attainment by 1% is associated with decreasing unemployment rates for Black adults by .5%.

64. Abrahamson, “College Affordability for Students in Illinois: On Illinois’ Disinvestment In Higher Education & What Can Be Done About It.”

65. CEW Georgetown. “America’s Divided Recovery: College Haves and Have-Nots.” Accessed September 20, 2020. https://cew.georgetown.edu/cew-reports/americas-divided-recovery/. Of the jobs added since the last recession, 95% have required college credentials.

66. Attewell, Paul A., David E. Lavin, Thurston Domina, and Tania Levey. “New Evidence on College Remediation.” Journal of Higher Education 77, no. 5 (2006): 886–924.; Bailey, Thomas R., Shanna Smith Jaggars, and Davis Jenkins. Redesigning America’s Community Colleges : A Clearer Path to Student Success, 2015.

67. Coca, Vanessa, Jenny Nagaoka, and Alex Seeskin. “Patterns of Two-Year and Four-Year College Enrollment Among Chicago Public Schools Graduates.” To&Through Project. University of Chicago’s Urban Education Institute and the Network for College Success, October 2017. https://consortium.uchicago.edu/sites/default/files/2018-10/College%20Enrollment%20Patterns-Oct%202017-Consortium.pdf.

68. “Table 2.3d of the 2019 ISAC Data Book.” Among MAP applicants, a student at the average community college has less than $40,000 in income, compared to more than $60,000 for those at public universities.

69. Abrahamson, “College Affordability for Students in Illinois: On Illinois’ Disinvestment In Higher Education & What Can Be Done About It.”

70. Jones, Tiffany, and Andrew Howard Nichols. “Hard Truths.” The Education Trust (blog), January 15, 2020. https://edtrust.org/resource/hard-truths/.

71. Feldblum, Miriam, Steven Hubbard, Andrew Lim, Christian Penichet-Paul, and Hanna Siegel. “Undocumented Students in Higher Education” April 2020. https://www.presidentsalliance.org/wp-content/ uploads/2020/07/Undocumented-Students-in-Higher-Education-April-2020.pdf.; Earley, Neal. “Transgender and Undocumented Students Now Able to Access State College Aid.” Chicago Sun-Times, January 7, 2020. https://chicago.suntimes.com/education/2020/1/7/21055157/transgender-undocumented-students-immigration-state-college-aid-map-illinois-rise-act. Prior to the RISE Act going into effect in January of 2020, undocumented students in Illinois had not been able to access state-funded financial aid and as such, have had to finance college entirely out of pocket.

72. Anguiano, Viviann. “Undocumented Students Generated Up to $132 Million in Relief to Colleges—But They Won’t Receive a Dime From the Stimulus.” Center for American Progress, May 5, 2020. https://www. americanprogress.org/issues/education-postsecondary/news/2020/05/05/484505/undocumented-students-generated-132-million-relief-colleges-wont-receive-dime-stimulus/.

73. Abrahamson, “College Affordability for Students in Illinois: On Illinois’ Disinvestment In Higher Education & What Can Be Done About It.” Attending college in a more rural area is correlated with lower transfer rate to 4-year institutions.

74. Ibid.

75. For instance, the state’s funding formula might account for differences in undergraduate tuition and fees as a share of total operating revenue, as well as other sources of operating support (e.g., revenues generated through auxiliary enterprises and research, or major gifts).

76. Jaschik, Scott. “Study: Grades Are 5 Times Stronger Than ACT Scores.” Inside Higher Ed, January 29, 2020. https://www.insidehighered.com/quicktakes/2020/01/29/study-grades-are-5-times-stronger-act-scores

77. Illinois Nursing Workforce Center. “Welcome.” Accessed October 6, 2020. http://nursing.illinois.gov/.

78. Analysis of IPEDS data by Advance Illinois.

79. 7Bragg, Debra, and Tim Harmon. “Community College Baccalaureate Labor Market Analysis.” Webinar, n.d.

80. “Chapter I & Table I-2.” PCC analysis of data on enrollment by race compared to state demographics.

81. “State Higher Education Finance FY 2019.” SHEF. State Higher Education Executive Officers Association, n.d. https://shef.sheeo.org/wp-content/uploads/2020/04/SHEEO_SHEF_FY19_Editorial.pdf.

82. Center for Tax and Budget Accountability. “Addressing Illinois’ Pension Debt Crisis With Reamortization.” Center for Tax and Budget Accountability, May 21, 2018.

83. Carnevale, Anthony P., Artem Gulish, and Jeff Strohl. “Educational Adequacy in the Twenty-First Century.” The Century Foundation, May 2, 2018. https://tcf.org/content/report/ educational-adequacy-twenty-first-century/.