DENVER — A Democrat state representative, who previously sought to eliminate the return of over-collected tax revenue to Coloradans under the state’s Taxpayer’s Bill of Rights (TABOR) amendment, is now bizarrely claiming credit for the constitutionally-mandated refunds scheduled to go out this year.

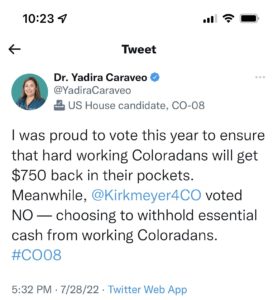

State Rep. Yadira Caraveo, who is running to represent Colorado’s newly formed Congressional District 8, Tweeted out Friday morning “I was proud to vote this year to ensure that hard working Coloradans will get $750 back in their pockets. Meanwhile @Kirkmeyer4CO (her Republican opponent, State Sen. Barbara Kirkmeyer) voted NO —choosing to withhold essential cash from working Coloradans.”

State Rep. Yadira Caraveo, who is running to represent Colorado’s newly formed Congressional District 8, Tweeted out Friday morning “I was proud to vote this year to ensure that hard working Coloradans will get $750 back in their pockets. Meanwhile @Kirkmeyer4CO (her Republican opponent, State Sen. Barbara Kirkmeyer) voted NO —choosing to withhold essential cash from working Coloradans.”

But according to Kirkmeyer, Caraveo’s Tweet was a complete distortion of the events that led up to Coloradans who filed their taxes by June 30 getting TABOR refunds earlier than otherwise, via Senate Bill 233, passed in the 2022 legislative session.

Kirkmeyer said the Tweet was disingenuous to voters in her district, calling the early refunds a political backroom deal.

“They came up with this to make it look like they were giving people a stimulus check,” Kirkmeyer said. “Here is this woman who wishes there wouldn’t even be a TABOR and who has voted for every tax increase acting like this refund is anything other than a constitutional requirement.”

Kirkmeyer said unequivocally that she was a no vote on the bill because of the timing issues and because it was misleading.

“I voted for TABOR in 1992,” Kirkmeyer said. “In no way did I vote to ‘withhold essential cash’ from working Coloradans. I also voted against all those tax increases my opponent voted for. The Dems all act like they are doing us a favor.”

Kirkmeyer called the move political grandstanding in an election year that insiders say will result in Republicans taking back legislatures and governorships across the country, including Colorado.

“They are trying to cover up poor policy in an election year when they’ve passed dozens of new taxes and fees the past few years. They’ve made it hard for Coloradans to afford to live. I’m surprised they didn’t just put the check in with the mail-in ballots. They are just trying to buy votes.”

Caraveo has long been an opponent of TABOR. In fact, she was a co-sponsor on a bill in 2019 that the legislature referred to voters in what came to be known as Proposition CC. The ballot measure would have forever eliminated TABOR refunds, allowing the legislature to keep and spend over-collected tax revenue in perpetuity. Prop CC failed overwhelmingly at the ballot.

TABOR refunds stem from a 30-year-old constitutional amendment that limits the state from raising taxes or exceeding a revenue limit on a portion of the state budget without first asking voters.

In years where revenue exceeds those limits, the state must either refund the money to taxpayers or ask voters to allow the state to keep it. The process has been in place for decades.

Colorado’s fiscal year runs from July 1 through June 30 every year. At the end of each fiscal year, the state predicts what the revenue will look like for the following fiscal year. If the revenue is expected to exceed the limits, taxpayers will get a refund.

For example, excess revenue for fiscal year 2020/2021 was refunded on the 2021 income tax return based on filing status and tax liability. There are six tiers of income level that determine how much the taxpayer receives.

The key word here is “taxpayers.” Prior to Senate Bill 233 — passed mostly on party lines — TABOR refunds were distributed to taxpayers who had a tax liability on their income tax return. However, for the next two years anyone who files by June 30 will get a check, regardless of tax liability.

Additionally, the refunds expected to hit mailboxes in August, are arriving more than six months early, as they are based on revenue projections for the 22/23 fiscal year and otherwise would not have been distributed until after 2022 tax returns were processed.

In fact, Gov. Jared Polis, who also advocated for the passage of Proposition CC and an end to TABOR refunds, went on television multiple times to encourage people to file a tax return by the deadline whether they were required to or not.

“We deserve the truth,” Kirkmeyer said. “First they try to water down TABOR, and now they are trying to take credit for it.”