Mortgage rates fall below 3% for the first time in history

Mortgage rates on the most common home loan dropped below 3% for the first time on record, which could help both homeowners and buyers during uncertain economic times.

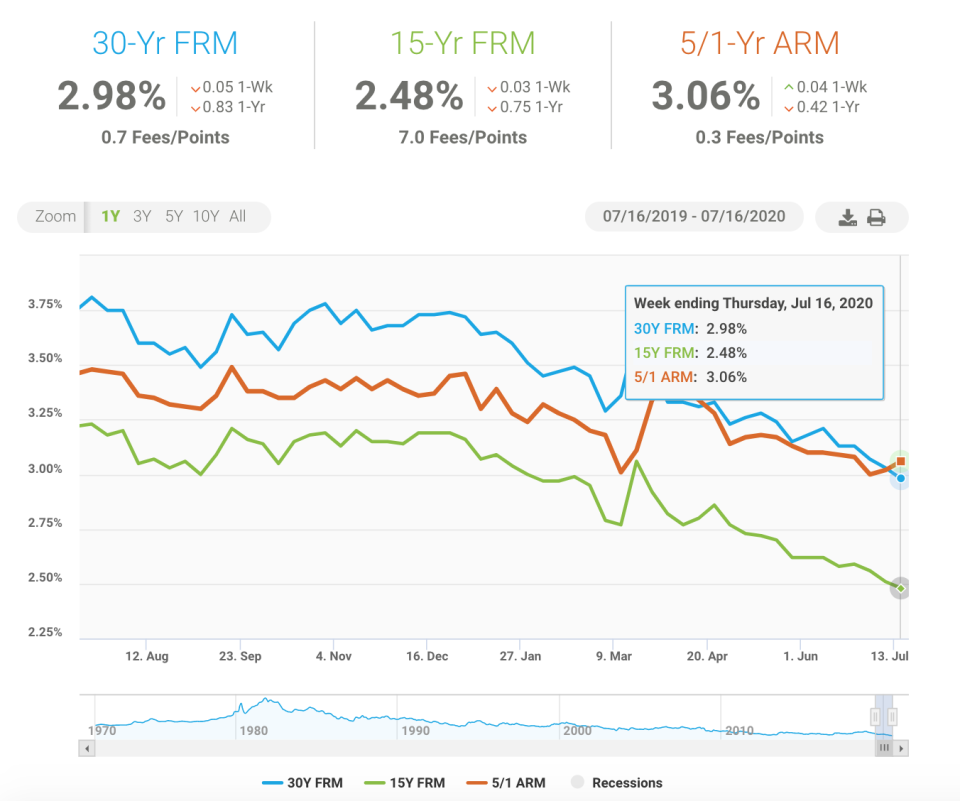

The average rate for the 30-year fixed mortgage sunk to 2.98% this week, down from 3.03% last week, according to Freddie Mac, the government agency that backs millions of mortgages for Americans. That marks the lowest level since Freddie Mac began tracking the rate in 1971 and the only time the rate fell below 3%.

Rates have consistently been carving out new lows as the coronavirus pandemic upends much of American life and the U.S. economy since the spring.

Read more: When to refinance a mortgage

“Mortgage rates hit a new all-time low...as the roller coaster of optimism and pessimism regarding the economic outlook continues,” said Danielle Hale, chief economist at realtor.com, a real estate listing site. “On the downside, an escalating number of coronavirus cases in a growing number of states demonstrates how hard the virus is to contain, especially when trying to jumpstart the economy.”

The rate drop could shave more than $100 off the monthly mortgage payments for current owners and homebuyers, Hale said.

Rates are eight-tenths of a percentage point lower than the same time last year, meaning “financing the typical home is $125 less per month versus the same-priced home at last year’s rates,” she said.

Read more: Coronavirus: What if you can't pay your mortgage?

“This is opening doors for many homebuyers, even as the number of homes available for sales dwindles,” she said.

A housing shortage continues to persist during the pandemic. A recent study by Freddie Mac found that nearly 2.5 million additional housing units across the U.S. are needed to meet pent-up demand.

Still, the continuing spread of the virus could be a major hurdle to home buying or refinancing, said Jeremey Sopko, CEO at Nations Lending, especially since many states have paused reopening as cases surpass 3.4 million in the United States.

“It's doubtful that falling rates alone would have a significant impact on refi or new purchase applications,” Sopko said. “At this point, with rates so low, the key influencing factor is likely to be consumer outlook on the health of the country."

Dhara is a reporter Yahoo Money and Cashay. Follow her on Twitter at @Dsinghx.

Read more:

Read the latest financial and business news from Yahoo Finance and Yahoo Money

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

money

money