(Bloomberg Opinion) -- The U.S. Securities and Exchange Commission is considering forcing large private companies to routinely disclose more financial information to the public.

To some, this may sound like a shocking imposition on private enterprise. But it’s really not if you consider how such financial reporting works elsewhere. Europe — and especially Britain — shows there’s an alternative to the extraordinary opacity of America’s private markets.

To recap briefly, U.S. companies with publicly traded securities have for decades been required by the SEC to disclose reams of information. In contrast, private companies aren’t obliged to publish even basic financial accounts. What little corporate data they disclose is submitted at the state rather than federal level. Accessing this information can be difficult, too. A race to the bottom has encouraged corporate secrecy.

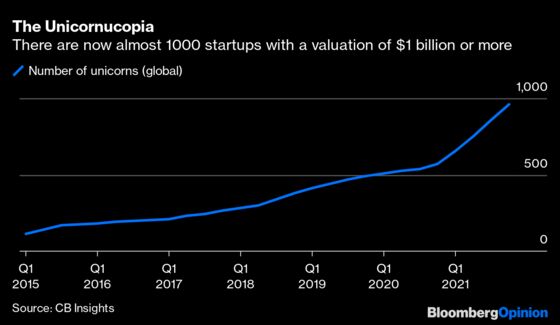

Some folks at the SEC think such leniency should no longer apply to the largest private firms, particularly unicorns, or startups worth $1 billion or more. Notwithstanding last year’s boom in IPOs and SPAC listings, the number of public companies has shrunk dramatically in the past two decades. Meanwhile, private equity-owned firms employ millions of people while startups often remain private for more than a decade before finally selling shares to the public. These businesses are transforming society while facing comparatively little financial scrutiny. In short, huge chunks of the U.S. economy have “gone dark.”

Fortunately, there’s another way: Private European businesses have to file audited annual accounts with their national government registries. The aim is to give the public easy access to these financial records online, along with other vital corporate information, such as the identity of directors and large shareholders (though regrettably some countries have dragged their feet on implementing the bloc’s stringent corporate transparency rules).

The reporting requirements are based on size rather than ownership structure. So the more revenue, assets and employees a business has, the more information it must disclose. This is a far more straightforward approach than that in the U.S., where companies with more than 2,000 individual investors must register with the SEC. In practice that threshold is rarely triggered, in part because employee-owners of start-ups aren’t counted.

“Compared with the U.S., Europe — and the U.K. in particular — is miles ahead,” says Chris Taggart, the founder of OpenCorporates, an open database of global corporate information. “Finding financial information on American private companies can feel more like detective work, it’s really hard.”

At this point, I’m sure some American readers are thinking: Sophisticated private market investors don’t need nannying by the SEC, and these regulatory burdens on private enterprise explain why Europe has become an economic backwater.

But that’s wrongheaded, Taggart argues. “I’ve never heard of markets becoming more efficient by having less information. A lack of visibility undermines competition and harms communities.”

Indeed, corporate transparency doesn’t just help law enforcement, journalists and civil society groups probe possible wrongdoing. It can reveal whether private capital is being allocated efficiently and responsibly.

Financial transparency would give us greater insight into pensions and university endowments, which are increasingly being invested in private markets. More information would also help businesses conduct due diligence on their suppliers and identify potential investment opportunities. And it would allow employees to better understand their employment prospects or what their startup equity might be worth.

This is also a matter of fairness. In return for the limited liability and tax advantages entrepreneurs enjoy, it’s reasonable to require them to reveal key information, says anti-money laundering expert and “Dark Money” podcast host Graham Barrow.

The focus shouldn’t just be on balance sheet items. To help tackle the climate crisis and guard against “dirty” assets being shifted to opaque private markets, large private companies should reveal much more about their environmental footprint, too. The U.K. is already requiring this from 2022.

Indeed, in many respects, the U.K. has set a gold standard for private company financial transparency. (I’m talking, of course, about the U.K. mainland, rather than its more financially opaque crown dependencies and overseas territories.) It scores an impressive 90/100 on an Open Company Data Index that measures the depth and accessibility of company information. The U.S. was awarded 34 points, only slightly better than China.

British companies, whether public or private, file accounts with Companies House, a government agency, which then publishes them on its easily searchable website for anyone to read for free. This holds records on more than 4.5 million businesses and the data is accessed an astonishing 10 billion times annually — clearly a lot of people find this service useful. The reporting goes well beyond a simple profit and loss statement: Since 2019, large private firms have been obliged to explain their corporate governance arrangements.

The U.K. was also one of the first to require private companies to publish the identities of their main shareholders or controlling entities. In an attempt to curb illicit activity, the U.S. will also soon start requiring shell companies to report on their “beneficial ownership;” however, this information will be held by the U.S. Treasury Department and won’t be accessible by the public.

The British system isn’t perfect: Companies House is a registry, not a regulator like the SEC, and thus isn’t responsible for investigating inaccurate filings, which are quite common. But reforms currently making their way through parliament could give Companies House more powers to query information and insist that financial data are filed in a digital format that’s easier to analyze.

Still, if the SEC wants to shed more light on private companies, it would learn a lot from studying what the Brits and Europeans do.

More From Other Writers at Bloomberg Opinion:

- The SEC’s Concern About Unicorns Misses the Point: Jared Dillian

- Private Markets Are The New Public Markets: Matt Levine

- The SEC Is Going Too Easy on Insider Trading: Michelle Leder

See also this recent paper on "The Breakdown of the Public–Private Divide in Securities Law", by George S. Georgiev, thisby Jennifer S. Fan on "Regulating Unicorns". Also"The Case for Mandatory Stakeholder Disclosure" by Ann M Lipton.

The thresholds are explained here. The very smallest companies are exempt from the audit requirement.

The EU is also expanding sustainability reporting rules to capture more private companies

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Chris Bryant is a Bloomberg Opinion columnist covering industrial companies. He previously worked for the Financial Times.

©2022 Bloomberg L.P.