Giant meatpackers like Cargill and JBS are the beneficiaries of billions of dollars of U.S. government subsidies. But they don’t get this money directly.

Instead, the government subsidizes farmers to grow crops like corn and soybeans. With lifeline subsidies favoring these crops above others, many farmers find themselves with little choice in what they grow. The result is a market often flooded with cheap corn and soybeans, with meatpackers standing at the ready to accept feed prices at below production cost.

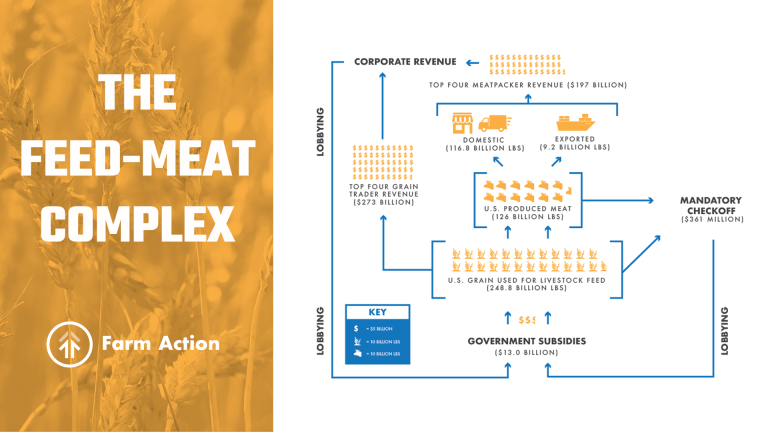

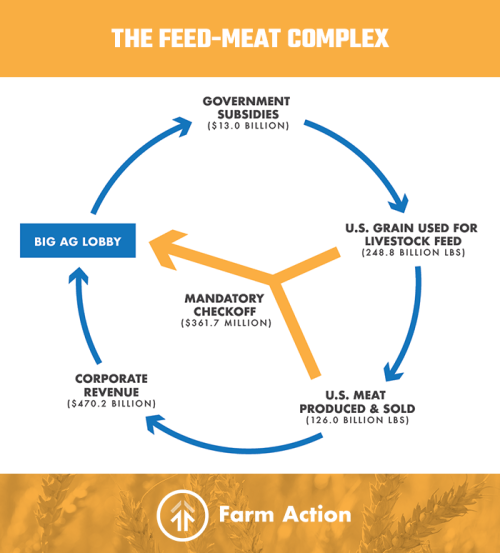

We call this system the Feed-Meat Complex.

Endless Rows of Corn and Soybeans

At first glance the Feed-Meat Complex might seem, well, complex, but that’s a big reason it has been able to exist in obscurity. We’re here to break it down.

There has been a worldwide shift towards using the majority of fertile soil for grains. But farmers across the world did not wake up one day and decide that they wanted to switch from varied crops that would sustain their communities to endless rows of corn and soybeans. It was up to Big Meat to apply the pressure.

Why corn and soybeans? In the U.S. alone, an estimated 248.8 billion pounds of corn, soybeans, sorghum, barley, oats, and canola are used to feed livestock and poultry. The majority of this livestock and poultry is controlled by a handful of multinational corporations. If these corporations can reduce the cost of their livestock and poultry feed, they will end up with more profit when they sell their beef, pork, or poultry.

But in an era of global food supply consolidation, it is not just about the money. A handful of corporations control an unprecedented amount of the world’s food supply, allowing for an unprecedented consolidation of power over our food supply — one of the most necessary resources for human survival. The irony that half of people on earth experiencing food insecurity are farmers should not be lost.

Over the past century, the economic viability of diversified, independent farming and processing has diminished, as farmers and ranchers have been forced to compete with corporations producing and selling on a massive scale. Big meatpackers knew this and were waiting on the other side for near-bankrupt farmers with a tempting offer: grow corn or soybeans, and you will be able to make a living, guaranteed.

The Role of Subsidies

The plot twist: at some point, the corporations realized they didn’t need to pay farmers their corn and soybean production cost. Instead, government subsidies could be leveraged to compensate farmers. This is the system we see in place today.

Billions of dollars in taxpayer-funded bailouts, subsidies, and crop insurance are paid out to farmers each year. These subsidies drive farmers to grow the crops most beneficial to big meatpackers, including soybeans and corn — what a coincidence.

Also driving the farmer is the need for bank loans. With government-funded crop insurance disproportionately allocated to corn and soybeans, the bank is more likely to lend the farmer needed capital when it sees a plan to grow those crops, knowing that good ol’ taxpayer funded insurance is there. Other crops like most fruits or vegetables? Too risky.

Pressured by loan policies, trying to keep their families fed, more and more farmers have started to grow corn and soybeans, leading to an oversaturated market and ever-lower feed prices. This chain reaction is not lost on big meat corporations.

The takeaway here is that big meat corporations are paying for very little within the system they have created. It’s been working, so you can bet that there is an incentive to keep it going.

Lobbying to Maintain the Status Quo

Think of the big meatpackers as the drivers in the feed-meat complex. They perpetuate the benefits of this system but often do so indirectly, making their efforts difficult to track. Lobbying for the continuation of subsidies is a great example.

The only big checks big meat companies are writing go to lobbying groups and our elected officials to make sure the subsidies, crop insurance, and bailouts continue to flow to the producers of their crops.

This effort has effectively led the U.S. farm economy to become entirely dependent on these subsidies. Today, government bailouts and subsidies make up an average of 44% of U.S. farmer income.

At first glance, it seems that international meat giants only spend a few hundred thousand on lobbying each year (a fraction of their cumulative 470 billion dollar annual revenue), but this is only the tip of the iceberg. These corporations have figured out how to further obscure their interests by deploying an army of lobbying groups based in the U.S. to fight for their interests. And yet again, these corporations have figured out they do not have to foot the bill.

Commodity checkoff programs were designed to collect a tax from all producers of certain commodities, cattle for example, and put these dollars towards advancing the beef industry through market research or technological innovation. Big Meat saw their opportunity and have effectively co-opted this system. Today we see already low income farmers paying this mandatory checkoff tax on their undervalued goods just for it to be funneled to a select few pro-corporate lobbying organizations.

These now-infamous lobbying organizations like the National Cattlemen’s Beef Association and the National Pork Producers Council have taken the lead on behalf of Big Meat to pressure policy makers into adopting further pro-corporate consolidation policies.

What It Means to Be a Farmer

The past decade has been fraught with lawsuits and protests from farmers, ranchers and policy makers, who have seen this not-so-sneaky checkoff system extract wealth from independent farms just to further stack the deck against them.

Some farmers and ranchers haven’t protested this arrangement, and this is important to note. Big meat needs a good number of farmers and ranchers on their side to be the caretakers for their livestock and feed grains. So not only is money allocated to pro-corporate federal policy, it is also used to train farmers, reframing the way they view agriculture altogether.

Simple paradigm shifts like referring to pig farmers as pork producers, or asking farmers how many bushels per acre they’ve harvested instead of dollars made per acre, has aided in disconnecting farmers from their land and animals. Ultimately it has undermined a farmer’s true understanding of the market value of what they produce.

Conclusion

If you’ve made it this far, you now understand that big meat corporations are using a multi-step approach to reducing their cost of production and consolidating the world’s food supply. The apparent complexity of these approaches have allowed them to largely fly under the radar as they live off of taxpayer dollars, reaping record profits, and bankrupting farmers.

It’s about time we break down this complex, set the record straight, and hold Big Meat accountable.

Graphics Sources:

GOVERNMENT SUBSIDIES: 2016 Agriculture Risk Coverage (ARC) and Price Loss Coverage (PLC) programs (USDA-ERS), Foreign Market Development FY16 Funding Allocations (USDA-FAS), Federal Crop Insurance Corporation Commodity Year Statistics (USDA-RMA)

U.S. GRAIN FOR LIVESTOCK FEED: 2016 feed grain and residual (USDA-ERS Feed Grains Data, 9/14/20), 2016 soybean, and 2016 canola production (USDA-ERS Oil Crops Yearbook)

U.S. MEAT PRODUCED & SOLD: 2016 federally inspected beef, veal, pork, lamb and mutton, broilers, other chicken, and turkeys (USDA-ERS Meat Statistics, 8/25/20), excluding exported amounts

CORPORATE REVENUE: 2016 corporate revenue (Tyson Foods, JBS SA, Cargill, Smithfield, ADM, Bunge, Louis Dreyfus) (statista.com)

MANDATORY CHECKOFF: Lamb, beef, soybean, pork (GAO-18-54. Agricultural Promotion Programs. November 2017. https://www.gao.gov/products/GAO-18-54), Corn (estimated from 2016 US production amount at assessment of $0.01/bu).

BIG AG LOBBY: Cumulative sum of corporate revenue, mandatory checkoff assessment, and agribusiness PAC and lobbyist expenditures by livestock and grain commodity groups and associations ($70.2 million); (https://www.opensecrets.org/industries/indus.php?Ind=A), NCBA 2016 Annual Report (https://www.ncba.org/CMDocs/BeefUSA/2016%20Federation%20Investor%20Report.pdf)

Writing and graphics concept by Anna Straus; blog designed by Angela Huffman and Dee Laninga; graphics designed by Lindsy Warnecke, AR Marketing; edited by Angela Huffman, Dee Laninga, and Joe Maxwell; blog concept developed from “The Food System: Concentration and Its Impacts” report by Mary K. Hendrickson, Philip H. Howard, Emily M. Miller, and Douglas H. Constance.