2020 Was a Surprisingly Strong Year for Housing. Here’s Why 2021 Will be Stronger.

2021 is on pace to be the strongest year for the housing market since 2005, riding a wave of strong and sustainable fundamentals.

2021 is on pace to be the strongest year for the housing market since 2005, riding a wave of strong and sustainable fundamentals.

Home sales and price growth quickly re-accelerated after a brief pause in the spring, and the housing market has become a true silver lining in what has otherwise been a tumultuous year for the economy. We expect this wave of home value and sales growth to continue to grow into 2021, putting next year on pace to be the strongest year for the housing market since 2005.

Zillow’s expectation is that 5.7 million existing homes will be sold by the end of this year, up 5.9% from 2019. This growth – a testament to enduring and resilient consumer demand for housing – reverses a period of sales stagnation from the past couple years, and is a remarkable achievement on its own given the ongoing difficulties and uncertainties posed by the pandemic. But while 2020 will end up being a strong year for the housing market by most measures, it will pale in comparison to 2021.

We are forecasting almost 6.9 million existing homes will be sold in calendar year 2021, the most sales recorded in a single calendar year since 2005 and the largest one-year increase (21.9%) since the early 1980s.

Several factors are driving our bullish outlook for next year. The first is simple momentum — near-term, forward-looking indicators of home purchases have been exceptionally strong in recent months, and that strength is expected to continue. Purchase mortgage applications have risen consistently year-over-year since May, averaging 22% annual growth over that period. And an index of pending home sales from the National Association of Realtors – a look ahead at sales expected to officially close over the ensuing few months — has also experienced double-digit annual growth since June, and was almost 20% year-over-year in October.

Continued low mortgage interest rates and favorable demographic tailwinds are both expected to contribute to a strong year for home sales in 2021. Mortgage rates continue to hold near their all-time lowest levels, helping keep monthly costs low even as prices rise and drawing more buyers into the market, and the likely gradual nature of the economic recovery will place limited upward pressure on rates in the coming year. The swell of millennial buyers – with the also-enormous Gen Z cohort right behind them — aging into their prime homebuying years and looking to enter the market should also help keep demand firm and prompt steady growth in household formation.

Pre-pandemic, 2020 was shaping up to be a strong year for home sales. Sales figures in February 2020 were the highest they had been in 13 years, and the runway for continued growth was clear from there. Of course, we know what happened instead – sales plummeted over the next two months as the market froze in the early days of the pandemic, falling to their lowest level since 2010. But the housing market quickly bounced back as buyers, sellers and agents found new, safer ways of conducting business. By early summer, the market forces that drove the strong start to the year – favorable buying conditions for those qualified, strong demand and limited supply that increased competition and helped speed up the market — were increasingly reasserting themselves, reigniting sales growth.

Even so, sales are still catching up to where we would have expected them to be at this point in the year if the spring freeze hadn’t happened, but they are not far behind. This suggests there may be some sales put off in the spring that could still be made up in the waning weeks of 2020 and early 2021. The aforementioned financial and demographic forces, combined with a year-plus of pandemic and quarantine life that has reshaped people’s housing needs, priorities and opportunities will help ensure high demand persists well into 2021.

We expect sales volumes to peak in April 2021 at a seasonally adjusted annual rate of 7.01 million, in line with typical seasonal trends that see sales peak in spring, but remaining well-above both 2020 and longer-term averages throughout the year.

This growth in completed sales is expected to happen despite inventory levels that remain low by historic standards, increasing speed and competition in the market for those homes that do come to market. In the back half of 2020, homes typically spent only two weeks on the market before going pending, well below levels from the same time in prior years. Buyers are finding new ways to quickly make deals for the homes they like, aided by tech tools including push notifications when new listings arrive, virtual tours that allow on-demand viewing of homes and online closing tools. But this elevated demand and increased competition are also helping drive up home values themselves at a torrid pace.

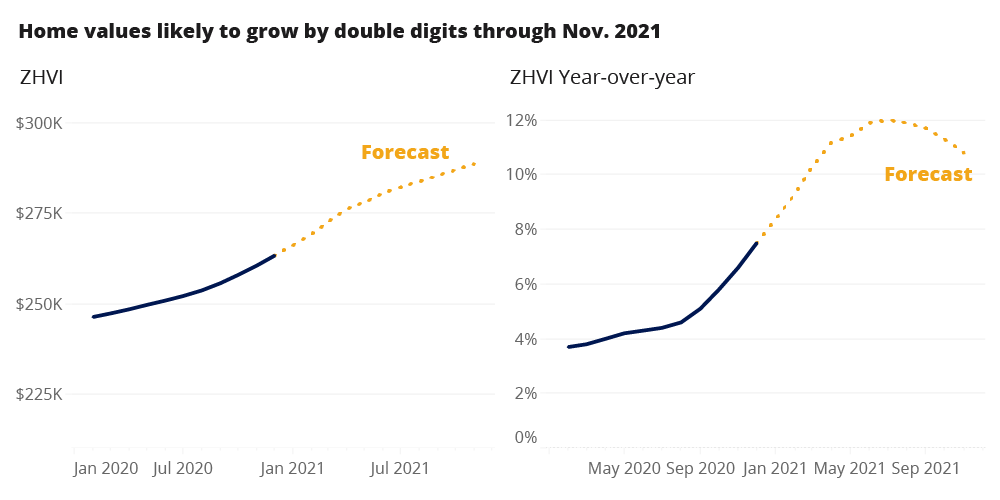

In November, the U.S. Zillow Home Value Index grew by 1.1% from October – the strongest monthly rate of appreciation on record, dating back to 1996. We expect annual home value growth to peak at 12% in June, and for the typical U.S. home to grow in value by 10.3% in the 12 months from November 2020 through November 2021, from $263,351 to $290,376.

It is possible that this rapid pace of home value growth could grow into a substantial headwind for housing affordability — saving an adequate down payment remains a significant challenge that low mortgage interest rates can’t solve, particularly for younger and/or lower-income buyers. Limited inventory of more-affordable, entry-level homes is also a challenge. That said, rising prices may also encourage more homeowners to list their homes for sale and capitalize on recent gains in equity, especially if/when a COVID vaccine helps ease anxiety and uncertainty. This will have the effect of adding at least some more inventory to the market and easing some of the upward pressure on prices, which we expect to occur beginning in mid-2021.

Against some odds, and somewhat surprisingly, 2020 was a good year for housing. Unencumbered by pandemic restrictions and with the complete realization of the market’s potential for growth as developing fundamentals from prior years fully take hold will help ensure 2021 will be even better.