Overall Loan Activity Down 11 Percent, Marking Third Straight Quarterly Decrease; Lending Down at Fastest Rate Since Early 2019; Refinance, Purchase, Home-Equity Mortgages All Down Quarterly

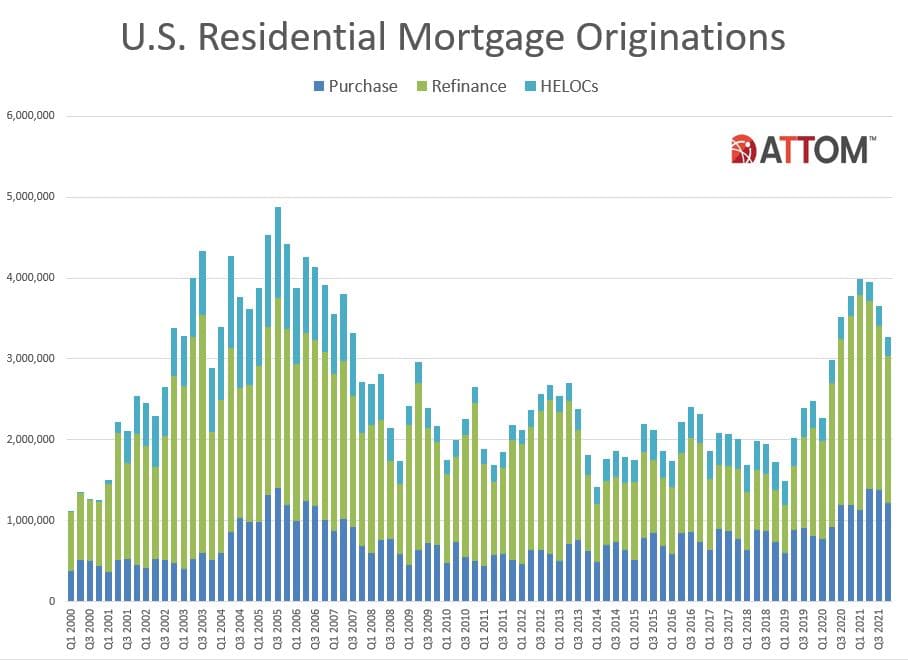

IRVINE, Calif. – Mar. 3, 2022 — ATTOM, a leading curator of real estate data nationwide for land and property data, today released its fourth-quarter 2021 U.S. Residential Property Mortgage Origination Report, which shows that 3.27 million mortgages secured by residential property (1 to 4 units) were originated in the fourth quarter of 2021 in the United States. That figure was down 11 percent from the third quarter of 2021 and 13 percent from the fourth quarter of 2020.

The total number of mortgages issued was down for the third quarter in a row while the annual decrease marked the largest since late 2018. The overall drop-off resulted from across-the-board quarterly declines in all three categories of conventional loans – purchase, refinance and home-equity. Only purchases lending remained up from a year earlier.

Overall, lenders issued $1.06 trillion worth of mortgages in the fourth quarter of 2021. That was down quarterly by 9 percent and annually by 7 percent. Both decreases in the dollar volume of loans were the largest since the early part of 2019.

On the refinance side, 1.81 million home loans were rolled over into new mortgages during the fourth quarter of 2021, a figure that was down 11 percent from the third quarter and 23 percent from a year earlier. The total number of refinance mortgages decreased for the third straight quarter while the annual drop was the largest in three years. The dollar volume of refinance loans was down 9 percent from the third quarter of 2021 and 18 percent annually, to $578 billion.

Refinance mortgages, while still a majority of residential lending activity, decreased again as a portion of all loans during the fourth quarter of 2021. They represented 55 percent of all fourth-quarter mortgages, down from 56 percent in the third quarter of 2021 and 62 percent in the fourth quarter of 2020.

The number of purchase loans also declined in the fourth quarter of 2021 as lenders issued 1.22 million mortgages to buyers. That was down 11 percent quarterly, although still up annually by 3 percent. The dollar value of loans taken out to buy houses and condominiums dipped to $439 billion, down 10 percent from the third quarter of last year but still up 14 percent from the fourth quarter of 2020. As a portion of all lending, purchase loans slipped from 38 percent in the third quarter of 2021 to 37 percent in the fourth quarter 2021, while still up annually from 32 percent.

Home-equity lending also dropped quarterly, by 5 percent, to about 230,700, although that number represented a slight increase in the total portion of all loans.

The decrease in all three mortgage categories during the fourth quarter, as well as the third straight drop in total lending, represented another sign that the near-tripling of lending activity from 2019 through 2021 has ended, at least temporarily. The latest numbers likely reflect several trends coming together at the same time. They include homeowner appetite for refinance loans finally getting satisfied and mortgage rates ticking upward. In addition, a tight supply of homes for sale throughout the Coronavirus pandemic has helped drive prices up but purchases down.

“The receding volume of business for the residential mortgage industry is now showing up across all major categories of loans and appears to be more than just a temporary slide. The ebbing wave of refinance loan that started in early 2021 has fully spread to home-purchase and home-equity lending,” said Todd Teta, chief product officer at ATTOM. “No doubt, total lending levels are still up over normal amounts over the past decade. And the drop-off in purchase loans seems to flow from a lack of housing supply rather than the housing market boom ending. But declining business for lenders remains a key point to watch in assessing the state of the market, especially with interest rates likely to climb this year.”

Total mortgages drop at fastest pace in three years

Banks and other lenders issued 3,266,907 residential mortgages in the fourth quarter of 2021. That was down 10.7 percent from 3,656,892 in third quarter of 2021 and down 13.5 percent from 3,775,894 in the fourth quarter of 2020.

The quarterly and annual declines were the largest since the first quarter of 2019 or the fourth quarter of 2018, respectively. The latest total also was 18.1 percent less than the peak hit in the first quarter of 2021.

The $1.06 trillion dollar volume of all loans in the fourth quarter was down 9 percent from $1.17 trillion in the prior quarter and 6.5 percent less than the $1.14 trillion lent in the fourth quarter of 2020.

Overall lending activity decreased from the third quarter of 2021 to the fourth quarter of 2021 in 195, or 91 percent, of the 215 metropolitan statistical areas around the U.S. with a population of more than 200,000 and at least 1,000 total residential mortgages issued in the fourth quarter. Total lending activity was down at least 5 percent in 163 metros (76 percent). The largest quarterly decreases were in Provo, UT (down 54.3 percent); Huntsville, AL (down 53.9 percent); Hickory-Lenoir, NC (down 48.5 percent); Pittsburgh, PA (down 43.8 percent) and Peoria, IL (down 40.9 percent).

Aside from Pittsburgh, metro areas with a population of least 1 million that had the biggest decreases in total loans from the third to the fourth quarter of 2021 were St. Louis, MO (down 22.1 percent); San Jose, CA (down 19.6 percent); Birmingham, AL (down 17.4 percent) and Chicago, IL (down 17.1 percent).

Metro areas with the biggest increases in the total number of mortgages from the third to the fourth quarter of 2021 were Buffalo, NY (up 25 percent); Utica, NY (up 13.6 percent); Hilton Head, SC (up 11.6 percent); Shreveport, LA (up 8.2 percent) and New Orleans, LA (up 6.8 percent).

Aside from Buffalo and New Orleans, the only metro areas with a population of at least 1 million and an increase in total mortgages from the third quarter to the fourth quarter of 2021 were Raleigh, NC (up 2.7 percent); Baltimore, MD (up 2.4 percent) and Cleveland, OH (up 1.1 percent).

Refinance mortgage originations down 11 percent from third quarter

Lenders issued 1,812,512 residential refinance mortgages in the fourth quarter of 2021, down 10.8 percent from 2,033,085 in third quarter of 2021 and down 22.7 percent from 2,345,117 in the fourth quarter of 2020. The total was down for the third straight quarter, which had not happened since late 2018 into early 2019. The $578 billion dollar volume of refinance packages in the fourth quarter of 2021 was down 9 percent from $635.4 billion in the prior quarter and down 17.5 percent from $700.7 billion in the fourth quarter of 2020.

Refinancing activity decreased from the third quarter of 2021 to the fourth quarter of 2021 in 193, or 90 percent, of the 215 metropolitan statistical areas around the country with enough data to analyze. Activity dropped at least 10 percent in 101 metro areas (47 percent). The largest quarterly decreases were in Provo, UT (down 55.3 percent); Huntsville, AL (down 52.3 percent); Pittsburgh, PA (down 46.6 percent); Hickory-Lenoir, NC (down 42.9 percent) and Peoria, IL (down 35.3 percent).

Aside from Pittsburgh, metro areas with a population of least 1 million that had the biggest decreases in refinance activity from the third to the fourth quarter of 2021 were Salt Lake City, UT (down 29.8 percent); San Jose, CA (down 23.2 percent); St. Louis, MO (down 22 percent) and San Francisco, CA (down 19.3 percent).

Counter to the national trend, metro areas with the biggest increases in refinancing loans from the third to the fourth quarter of 2021 were Utica, NY (up 62.4 percent); Buffalo, NY (up 25.1 percent); Shreveport, LA (up 14.8 percent); Sioux Falls, SD (up 11.5 percent) and Baton Rouge, LA (up 11 percent).

Aside from Buffalo, the only metro areas with a population of at least 1 million where refinance mortgages increased from the third to the fourth quarter of 2021 were New Orleans, LA (up 10.4 percent); Cleveland, OH (up 10.1 percent) and Baltimore, MD (up 2.1 percent).

Refinance lending still represents at least 50 percent of all loans in three quarters of metros

Despite the continued decline in refinance activity, those loans still accounted for at least half of all mortgages issued in the fourth quarter of 2021 in 155 (72 percent) of the 215 metro areas with sufficient data to analyze. That was the same portion as in the third quarter of 2021 but down from 91 percent a year earlier.

Metro areas with a population of at least 1 million where refinance loans represented the largest portion of all mortgages in the fourth quarter of 2021 were Atlanta, GA (73.1 of all mortgages); Detroit, MI (67.2 percent); New Orleans, LA (64.3 percent); Kansas City, MO (62.3 percent) and Providence, RI (62.2 percent).

Metro areas with a population of at least 1 million where refinance loans represented the smallest portion of all mortgages in the fourth quarter of 2021 were Rochester, NY (43.6 percent of all mortgages); Oklahoma City, OK (43.9 percent); Buffalo, NY (47.2 percent); Salt Lake City, (47.9 percent) and Grand Rapids, MI (49.1 percent).

Purchase originations decrease 11 percent in fourth quarter

Lenders originated 1,223,661 purchase mortgages in the fourth quarter of 2021. That was down 11.3 percent from 1,379,671 in the third quarter, although still up 2.8 percent from 1,189,920 in the fourth quarter of 2020. The $439 billion dollar volume of purchase loans in the fourth quarter of 2021 was down 10 percent from $487.5 billion in the prior quarter, but remained up 14.1 percent from $384.6 billion a year earlier.

Residential purchase-mortgage originations decreased from the third to the fourth quarter of 2021 in 186 of the 215 metro areas in the report (87 percent). The largest quarterly decreases were in Provo, UT (down 55.2 percent); Hickory-Lenoir, NC (down 54.1 percent); Huntsville, AL (down 53.5 percent); Sioux Falls, SD (down 51.5 percent) and Pittsburgh, PA (down 48.2 percent).

Aside from Pittsburgh, metro areas with a population of at least 1 million that saw the biggest quarterly decreases in purchase originations in the fourth quarter of 2021 were St. Louis, MO (down 23.3 percent); Atlanta, GA (down 21.6 percent); Rochester, NY (down 21.4 percent) and Chicago, IL (down 20.7 percent).

Residential purchase-mortgage lending increased from the third quarter of 2021 to the fourth quarter of 2021 in 29 of the 215 metro areas reviewed (13 percent). The largest increases were in Buffalo, NY (up 25.3 percent); Lakeland, FL (up 17.8 percent); Salt Lake City, UT (up 17.7 percent); Lafayette, IN (up 13.3 percent) and Brownsville, TX (up 11.7 percent).

Aside from Buffalo and Salt Lake City, metro areas with a population of at least 1 million and the largest increases in purchase originations from the third to the fourth quarter of 2021 were Raleigh, NC (up 8.3 percent); Tucson, AZ (up 6.9 percent) and Baltimore, MD (up 4.9 percent).

Metro areas with a population of at least 1 million where purchase loans represented the largest portion of all mortgages in the fourth quarter of 2021 were Oklahoma City, OK (50.6 percent of all mortgages); Las Vegas, NV (44.4 percent); Miami, FL (44.2 percent); Virginia Beach, VA (42.5 percent) and San Antonio, TX (42.2 percent).

Metro areas with a population of at least 1 million where purchase loans represented the smallest portion of all mortgages in the fourth quarter of 2021 were Detroit, MI (23.7 percent of all mortgages); Atlanta, GA (26.3 percent); Boston, MA (29.3 percent); Kansas City, MO (29.9 percent) and Pittsburgh, PA (32.1 percent).

HELOC lending down 5 percent

A total of 230,734 home-equity lines of credit (HELOCs) were originated on residential properties in the fourth quarter of 2021, down 5.5 from 244,136 during the prior quarter and down 4.2 percent from 240,857 in the fourth quarter of 2020. HELOC activity dropped for the first time since the first quarter of 2021. The $45.6 billion fourth-quarter volume of HELOC loans was down 3 percent from the third quarter and 11 percent from the fourth quarter of 2020.

HELOC mortgage originations decreased from the third to the fourth quarter of 2021 in 68 percent of the metro areas analyzed. The largest decreases in metro areas with a population of at least 1 million were in Atlanta, GA (down 36.1 percent); San Antonio, TX (down 23.3 percent); Houston, TX (down 19.1 percent); Austin, TX (down 18.5 percent) and St. Louis, MO (down 15.9 percent).

The biggest quarterly increases in HELOCs among metro areas with a population of at least 1 million were in Cleveland, OH (up 32.7 percent); Buffalo, NY (up 24.3 percent); Raleigh, NC (up 21.7 percent); Philadelphia, PA (up 13.5 percent) and Detroit, MI (up 10.6 percent).

FHA loan portion up while VA share decreases

Mortgages backed by the Federal Housing Administration (FHA) accounted for 319,334 or 9.8 percent of all residential property loans originated in the fourth quarter of 2021. That was up from 9.3 percent in the third quarter of 2021, although still down from 10.7 percent in the fourth quarter of 2020.

Residential loans backed by the U.S. Department of Veterans Affairs (VA) accounted for 197,313, or 6 percent, of all residential property loans originated in the fourth quarter of 2021, down from 6.4 percent in the previous quarter and 8.4 percent a year earlier.

Median down payments tick down while loan amounts go up

The national median down payment on homes purchased with financing decreased slightly during the fourth quarter of 2021 while the typical amount borrowed rose to another new high. Meanwhile, the ratio of median down payments to home prices stayed about the same.

The median down payment on single-family homes purchased with financing in the fourth quarter of 2021 was $26,000, down 1 percent from $26,250 in the previous quarter but still up 18.8 percent from $21,891 in the fourth quarter of 2020.

Among homes purchased with financing in the fourth quarter of 2021, the median loan amount was $293,400. That was up 1.3 percent from the prior quarter and up 10.5 percent from the same period in 2020.

Report methodology

ATTOM Data Solutions analyzed recorded mortgage and deed of trust data for single-family homes, condos, town homes and multi-family properties of two to four units for this report. Each recorded mortgage or deed of trust was counted as a separate loan origination. Dollar volume was calculated by multiplying the total number of loan originations by the average loan amount for those loan originations.

About ATTOM

ATTOM provides premium property data to power products that improve transparency, innovation, efficiency and disruption in a data-driven economy. ATTOM multi-sources property tax, deed, mortgage, foreclosure, environmental risk, natural hazard, and neighborhood data for more than 155 million U.S. residential and commercial properties covering 99 percent of the nation’s population. A rigorous data management process involving more than 20 steps validates, standardizes, and enhances the real estate data collected by ATTOM, assigning each property record with a persistent, unique ID — the ATTOM ID. The 30TB ATTOM Data Warehouse fuels innovation in many industries including mortgage, real estate, insurance, marketing, government and more through flexible data delivery solutions that include bulk file licenses, property data APIs, real estate market trends, property navigator and more. Also, introducing our newest innovative solution, that offers immediate access and streamlines data management – ATTOM Cloud.

Media Contact:

Christine Stricker

949.748.8428

christine.stricker@attomdata.com

Data and Report Licensing: