For mortgage bankers, 2020 was the “party for the ages.” National origination volume expanded by somewhere between 60 and 90 percent, depending upon how you keep score.

Of greater significance, production profit margins (excluding loan servicing net income and valuation adjustments) will come in at a four-to-five-times improvement over 2019 — which was, in itself, a very good year during which our industry enjoyed solid performance. At the extreme, STRATMOR has been working with an extraordinary midsize Independent Mortgage Banker (IMB) client whose production net income increased by over 10 times in 2020 versus 2019. Such examples of remarkable accomplishments are widespread across the mortgage banking spectrum.

After 40+ years in this industry, I’ve been through many mortgage cycles and have witnessed firsthand the booms, which are invariably followed by a significant and unprofitable downturn. In this article, I offer some candid and straightforward advice to help lenders prepare for the inevitable downturn bound to follow last year’s record-breaking origination volumes. After all, this is my last article before I retire, so I might as well be frank!

I hear the same economists repeatedly predicting that the Fed is committed to sustaining low interest rates until the pandemic retreats and economic recovery is confirmed. It is easy to become seduced into complacency by these prognostications. However, over my 40+ year mortgage banking career spanning almost 20 mortgage origination cycles, I cannot recall a single “soft landing” — when origination market conditions gradually normalized, allowing management time to develop an effective response.

I believe that prosperity of the magnitude we saw in 2020 can mask a handful of embedded and sometimes subtle risks, the combination of which could (or will) eventually cause a lasting hangover. But this can be mitigated to a certain degree with disciplined management practices. It is incumbent upon mortgage company leadership to think strategically and prepare a contingency plan — in advance of the inevitable downturn — rather than reacting under the pressure of negative origination market trending.

In 1987, STRATMOR represented Salt Lake City-based First Security Bank in its acquisition of CrossLand Mortgage, a top 20 independent mortgage banker (IMB) at that time. Within a few months of the closing date, mortgage rates jumped by almost 300 bps and the bank’s CFO labeled this transaction as his “worst deal ever.” In late 2011, STRATMOR represented Guild Mortgage in its acquisition of Seattle-based Liberty Financial. Along came the robust market of 2012 and this acquisition generated returns beyond our most optimistic pro forma.

In both cases, the acquirers were betting on a better market to come, a hit or miss proposition.

It’s time to stop basing planning and market expectations on the unpredictable and start utilizing proven management disciplines to proactively assess and navigate expected as well as unanticipated market trends. The data and historical events exist to do this effectively.

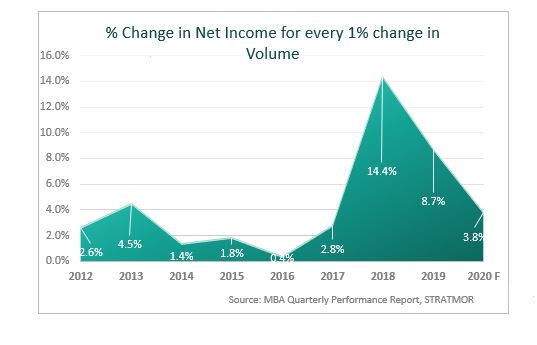

From hands-on experience, we all recognize that mortgage banking is an inherently cyclical business characterized by earnings volatility and driven by macro-economic forces that even the most professional economists cannot accurately predict. If we look to the findings of the MBA Quarterly Performance Report during 2012 through 2017, a period of so-called “normal” market conditions, industry profitability vacillated up or down by approximately three percent for every one percent change in volume. However, during the dramatically more volatile origination market of 2018-2020, profit margins moved by almost 10 percent (up or down) for every one percent change in volume.

Chart 1

In view of this historical reality, how can the mortgage banking industry expect a soft landing this time?

Historically, the duration of the average origination cycle is about three years. The current cycle incorporates 2018 (rotten market), 2019 (good market) and 2020 (fantastic market). What’s the probability that the current cycle will beat the odds and extend beyond the three-year average?

Before responding to this question, let’s be specific in identifying these potential embedded risk factors.

Beginning in Q2 of 2020, refinance borrower demand jumped dramatically, which coincided with the COVID-19 lockdown. Lenders had to rapidly adapt to fulfillment staff working from home, along with the very difficult task of managing data security threats, while accommodating the accelerated pace of unit volume. In our Operations Workshop conducted in November 2020, STRATMOR polled the 95 participants to measure the adoption rate of hybrid e-closings, full electronic closings and Remote Online Notarization (RON). For example, 65 percent of COOs reported that hybrid closings became an integral element of their 2020 workflow, and 95 percent made the same claim for prioritizing RON. While lenders clearly benefited from the elimination of face-to-face closings, the significant finding was that borrowers uniformly raved about their hybrid e-closing experience.

Given the enhanced efficiencies and improved borrower satisfaction, why do we think there will be some strategic risk to mortgage origination companies? Our response is an example of the subtle implications of the 2020 enhancements. The accelerated movement towards electronic closings is a major progression in the mortgage digitalization process, further removing complexity for the consumer. But borrower complexity has been the mortgage lenders’ best friend, a justification for the mortgage banker’s value proposition to the consumer. E-closings represent major advancement towards commoditization of the mortgage product. The competitive implications are enormous.

The great majority of STRATMOR’s clients strive for operational excellence as their competitive differentiator — “We guarantee your loan will be closed on time” is key to the referral source sales pitch and to recruiting loan officers. As a by-product of the mortgage digitalization revolution, what if every lender (large or small, IMB or bank-affiliated) can make the same claim? Then, the focus of competition quickly shifts to pricing. Production scale and operational efficiencies will drive cost structures. Lower cost mortgage banks can afford to be more price competitive.

One outcome of this scenario is a certainty: under normal market conditions, when origination capacity exceeds borrower demand, pricing competition will compress margins. We only have to look back to 2018 when the mortgage industry suffered one of its worst financial performances due to intense margin compression resulting from excess capacity.

Another risk to consider: the tremendous earnings of 2020 have bolstered lender balance sheets and created a war chest for prolonged pricing subsidies — not a favorable consideration for the next cycle downturn.

While discussing origination capacity, let’s analyze the national market outlook for 2021.

At STRATMOR, we typically look to a consensus volume forecast which averages the latest published projections of the MBA, Fannie and Freddie. The most recent consensus forecast for 2021 is $2.71 trillion, down $1 trillion (28%) from 2020. If we assume that the 2020 actual industry origination capacity is about $3.3 trillion, with the remainder accommodated by a combination of fulfillment staff overtime, contract underwriting and functional offshoring, it could mean excess capacity of approximately $600 billion, or 18 percent. In 2018, MBA Chief Economist Mike Fratantoni estimated the industry had 20 percent excess capacity for a large portion of the year which triggered margin compression such that IMB profitability declined from 32 bps in 2017 to 13 bps in 2018, or down 56 percent.

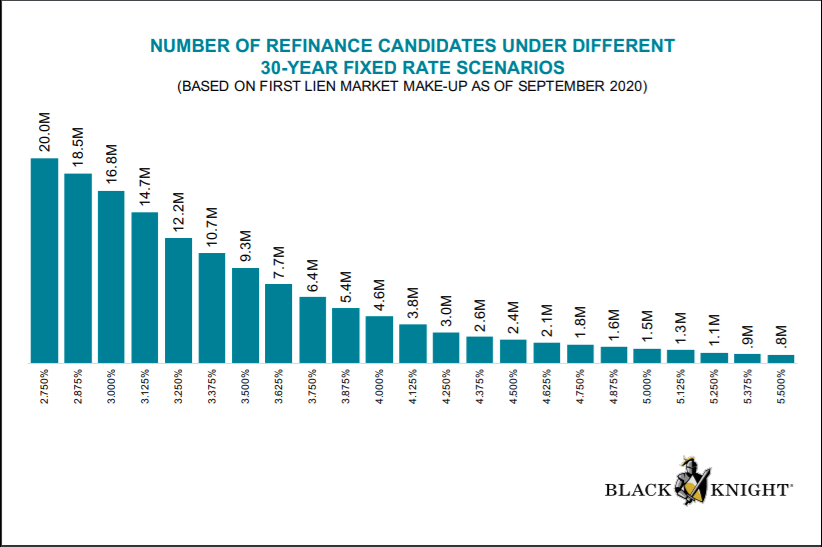

Black Knight (as shown on the table below) projects that the number of eligible refinance borrowers declines from 20 million households at a 30-year FRM of 2.75 percent to 10.7 million eligible borrowers at an FRM of 3.25 percent, a 47 percent fall-off at only a 50 bps increase in mortgage rates. This degree of sensitivity quantifies the potential market risk for 2021 and beyond.

Note that the MBA’s 2021 forecast calls for an average 30-year fixed rate mortgage of 3.2 percent. If the MBA forecast is accurate and refinance volume declines by $1 trillion, the financial risk of excess capacity will be thrust upon us.

Chart 2

We will now examine any potential downside impact of the various macro-economic forces that drive our industry, and as noted, these are difficult to predict with any degree of confidence.

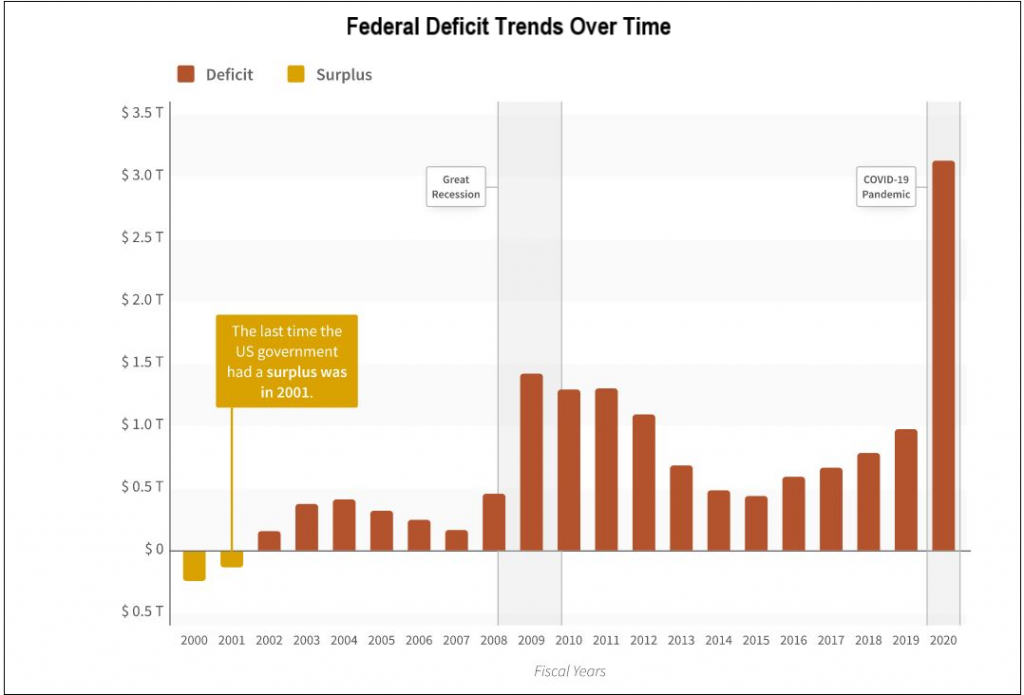

With the FY 2020 Federal deficit soaring to $3.7 trillion (including COVID-19 relief programs), it will increase by 3.6 times of the average federal deficit for the prior three years (see the chart below). Until the coronavirus pandemic is under control, a possible outcome is that Federal deficits will continue at unprecedented levels into 2021 and perhaps 2022.

Chart 3

Source: DataLab: https://datalab.usaspending.gov/americas-finance-guide/deficit/trends/ 2020.

Source: DataLab: https://datalab.usaspending.gov/americas-finance-guide/deficit/trends/ 2020.The outstanding Federal debt as a percentage of GDP has increased from 87 percent in 2010 to 127 percent in Q3 2020 which might eventually dilute U.S credit ratings. The major question here is whether the Treasury can fund this level of deficits at current rates. Will the 10-year Treasury at one percent be enough to fund the projected $6 trillion of additional deficits over the next two fiscal years? If the bond market investors push the 10 year to 1.5 percent, the 30-year FRM will rise to 3.25 percent and negatively impact refinance volume accordingly.

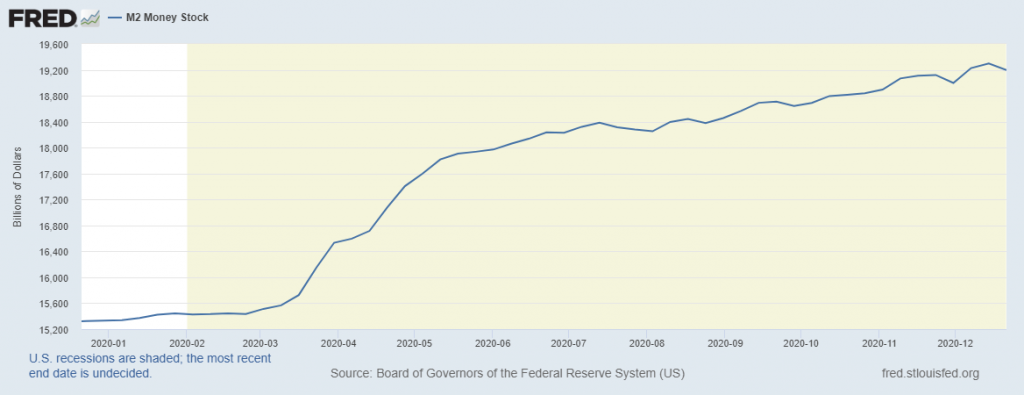

With the Federal Reserve monetizing the rising Federal debt and sustaining quantitative easing, the money supply has increased at extraordinary growth rates since March (see the chart below). This growth spike in the U.S. money supply is unprecedented. M2 rose 3.8 percent in March, 6.7 percent in April, and 5.0 percent in May, a stunning 83 percent annualized growth rate for three months.

Chart 4

This lifted the year-over-year growth rate of M2 to 23 percent, almost double its prior fastest rate in the modern era. Is there a possibility that such extraordinary expansion of the money supply in 2020 will trigger a resurgence of inflation in 2021 and beyond, thereby putting upward pressure on mortgage rates from the current record lows? Concerns about inflationary expectations have been dismissed by economists for the last decade, but 20 percent plus increases in the money supply might pose a new potential threat over the intermediate term.

Despite the severe adverse economic impact of the COVID-19 pandemic, the stock market is trading at a euphoric pace not seen in a decade. By some measures of stock valuation, the market is nearly at levels last seen in 2000, the year the dot-com bubble began to burst, thereby vaporizing 40 percent of the market’s value and crushing consumer confidence. The Wall Street Journal cites two traditional indicators of an over-valued stock market. Market participation by individual investors has increased dramatically since March. Secondly, margin debt reached an all-time high in November. “This milestone is an ominous sign for the stock market — margin debt records tend to precede bouts of volatility as seen in 2000 and 2008.”

How would a stock market correction influence mortgage originations? The consensus national mortgage market volume forecasts purchase originations to increase between 5 and 10 percent through 2023. A stock market downturn of magnitude would likely dampen the purchase market enthusiasm, reduce funds available for a down payment and erode consumer confidence. Since the forecasters are unanimous in their projection for refinance business to taper off during 2021, any reduction in purchase volume could be a double whammy for the mortgage industry.

On balance, the consensus forecast for the 2021/2022 mortgage origination volume assumes that none of these potential mortgage market/macro-economic risk factors will materialize in a meaningful fashion. This author is concerned that some combination of upward interest rate pressure, refinance market fatigue and/or excess origination capacity could emerge to undermine the relatively optimistic outlook for 2021. If the economy were to experience Federal deficit overload, a substantive stock market correction or even stepped-up inflationary expectations, these adverse macro-economic developments would impose another layer of risk to mortgage bankers.

Editorial Note: Neither STRATMOR nor the author are making a prediction that the 2021 mortgage market will experience performance deficiencies beyond what the MBA/Fannie/Freddie are forecasting. On the other hand, there is a possibility that some combination of the above risk factors will introduce adversity and challenges that must be confronted and remediated. And a “soft landing” would be a historical first.

Put together a contingency plan — now. The contingency planning process starts with preparing a budget which establishes your “Base Case” Pro-Forma for 2021 and the specific goals by which management will make contingency decisions. The discipline associated with budgeting is especially beneficial in a year of market uncertainty like 2021, which follows the extraordinary performance of 2020. The subject company budget should be segmented by quarter so that critical production and financial goals can be readily compared with actual results.

An effective contingency plan must establish quantifiable triggers with specific action steps. STRATMOR recommends that management determine such triggers based on volume declines and profit margin degradation. For example, a five percent reduction in the locked pipeline from the budgeted dollar volume for four consecutive weeks might kick start level one responses. Another (and perhaps concurrent) trigger would be a decline from budgeted Net Gain on Sale of five bps for four consecutive weeks. In this example, management must determine the actual trigger points based on their specific business model and strategic plan.

The more challenging element of a contingency plan is to determine the appropriate action steps if the volume and/or profit trigger occurs. The are several options here:

STRATMOR recommends that lender management dedicate resources to preparing a contingency plan designed to kick-in if the mortgage market shows early signs of deteriorating. Since there is rarely much lead time, we further recommend that this initiative be a first quarter 2021 priority so that decisions are not being made during subsequent periods of pressure induced stress. In view of the consensus prediction for a fall-off in production volume (e.g., down 23%), mortgage industry pundits believe that margin compression is inevitable, but the timing and magnitude of such compression is uncertain.

In conclusion, 2020 was a party for our industry and many executives hope to bottle that magic for use when the inevitable downturn occurs. Alas, this is the “pixie dust” approach which is a figment of our imagination. To protect what you have accomplished in building enterprise value, there is no easy substitute for engaging in a disciplined contingency planning process to prepare for that inevitable hard landing. It’s just a matter of time.

Heed the lessons learned from 2020 and the good and bad years that preceded it. Industry executives who are open to receiving and acting on this wisdom will be better positioned to succeed in 2021 and beyond, regardless of what performance challenges the market chooses to serve up. Many of them will spend time this year with STRATMOR consultants, who offer strategic advisory, operational optimization and merger and acquisition services to help executives navigate whatever market conditions the mortgage industry will face. Babcock

Contact us today for assistance for help with your strategic contingency plans.

STRATMOR works with bank-owned, independent and credit union mortgage lenders, and their industry vendors, on strategies to solve complex challenges, streamline operations, improve profitability and accelerate growth. To discuss your mortgage business needs, please Contact Us.