In a matter of months, the coronavirus triggered a period of financial shock for women in the American labor force. The economic implications of the virus continue to erode the decades of progress that began in the late 1950s. At that time, the percentage of women aged 16 and older who were either working or actively seeking employment was only 37 percent. In the years that followed, the participation rate for women began a steady climb, peaking at the end of the 20th century.

In December 2019, women held slightly more than half of all nonfarm jobs in the United States. A January 2020 Time.com article celebrated women’s economic gains, stating that the surge in female employment was due to major growth in the retail and health care industries.

Fast forward one year, and the devastating effects of COVID-19 on women in the workforce are undeniable. The formerly thriving, female-dominated industries continue to cut jobs, as evidenced by the additional 68,000 retail and health care jobs lost in January 2021.

According to BLS employment data, “In January, notable job gains in professional and business services and in both public and private education were offset by losses in leisure and hospitality, in retail trade, in health care, and in transportation and warehousing.”

Even when the employment outlook for women was good, many found themselves in low-wage, undervalued positions or settling for part-time jobs so they could care for children.

The pandemic has exacerbated the challenges women have always faced when it comes to representation in the U.S. workforce, and its effects are likely to last for years to come.

The Current Climate for Working Women

Between February and December of 2020, job losses for women exceeded those for men by 1 million. In December alone, the BLS reports, women lost 86.3 percent of the 227,000 job losses.

In total, 2.5 million women have left the labor force, compared with 1.8 million men.

The January 2021 unemployment data show higher rates for women of color:

- Latina women: 8.8 percent unemployment rate

- Black women: 8.5 percent unemployment rate

- Asian women: 7.9 percent unemployment rate

- White women: 5.1 percent unemployment rate

- Overall (men and women): 6.3 percent unemployment rate

Source: National Women’s Law Center

Extended periods of unemployment or part-time work can impact long-term financial security. Women need resilience, confidence and suitable opportunities for a successful return to the workforce.

Wage Disparities

Long before the coronavirus ravaged the U.S. economy, pay inequalities were a part of the working woman’s reality. According to the U.S. Census Bureau, wage gaps and financial security have been concerns for women, particularly women of color, nationwide.

In the fourth quarter of 2020, women workers’ median weekly earnings were 83.4 percent those of men, and incomes were even lower for Black and Hispanic women.

Nationally, the majority of minimum wage positions are held by women. Many of these lower-wage positions are in the service industry, which has been one of the hardest-hit sectors during the pandemic, seeing business closures and mass layoffs in the wake of COVID-19 restrictions and mandatory shutdowns.

Women are also more likely than men to face wealth-building barriers beyond pay inequalities.

Nationwide, Compared with All Single Men:

Single Black women own

2 cents to the dollar.

Single Latina women own

8 cents to the dollar.

All single women own

40 cents to the dollar.

Decelerators of wealth / wealth-building barriers:

- Student loan debt

- Costs associated with having children, caregiving responsibilities

- Gender stereotypes

- High health care costs

- High housing costs

- Low wages

- Layoffs

Source: Association for Financial Counseling & Planning Education

These decelerators affected women before COVID-19, and the presence of the coronavirus has compounded these issues. Kelley Griesmer, president and CEO of The Women’s Fund of Central Ohio, spoke on a panel for the Association for Financial Counseling & Planning Education. During the presentation, titled “Exploring COVID-19 from a Racial and Gender Lens,” Griesmer explained how societal and systemic misconceptions and biases have collided with the pandemic to create a “she-cession.”

“Even more women have had to choose to stay home with their children to support virtual learning because they don’t have the flexibility to make it work. Women are not going to choose between the safety of their children and their jobs.”

Kelley Griesmer, President and CEO, The Women’s Fund of Central Ohio

Many women are shouldering caregiving responsibilities as day care centers and schools close their doors to protect students and teachers. They now face the crossroads of job stability and family well-being.

Women who work part-time or in low-wage positions may not have adequate health benefits. Those who have been laid off may have lost their employer-sponsored health insurance. And single mothers are responsible for not only their own health care, but also the health care of their children. These women now have to pay out-of-pocket for their family’s health care.

These growing threats amplify the importance of society actively addressing the needs of women and people of color.

Michael Thomas, professor at the University of Georgia, told the AFCPE’s audience, “If we don’t have women who are thriving, then ultimately we don’t have children who are thriving. If we don’t have children who are thriving, then we don’t have a thriving nation, a thriving community, a thriving society.”

“If we don’t have women who are thriving, then ultimately we don’t have children who are thriving. If we don’t have children who are thriving, then we don’t have a thriving nation, a thriving community, a thriving society.”

Michael G. Thomas Jr., University of Georgia

Working Mothers

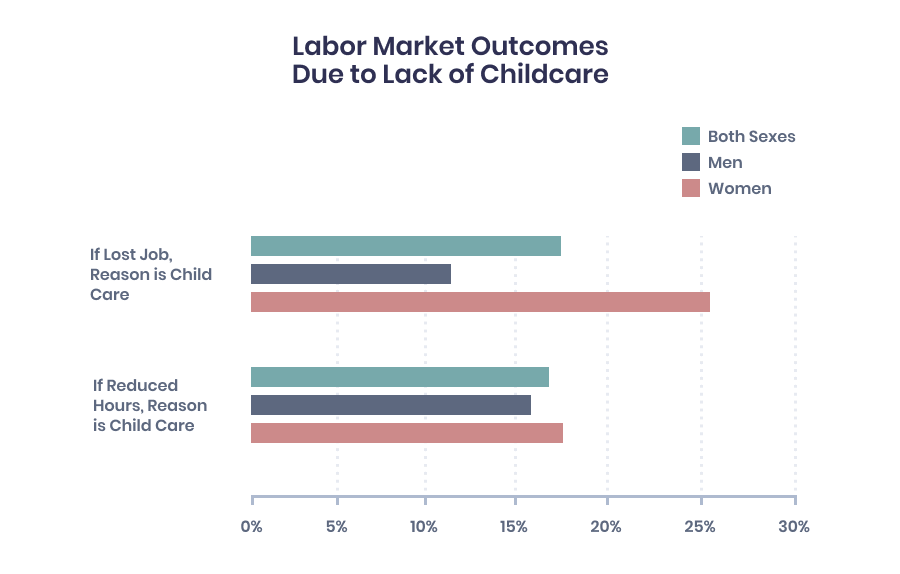

Many women balance family responsibilities with career demands. In May and June of 2020, researchers at Northeastern University surveyed 2,557 working parents to understand how the lack of child care affected the labor market amid the COVID-19 crisis. Two-thirds of the respondents reported having trouble securing caregivers for their children — double the number of parents who reported the same challenge before COVID-19.

The Northeastern University researchers also noted that women are more likely than men to assume the responsibility of caring for children when child care is unaffordable or unavailable.

“In all, of those saying that they lost a job due to a lack of child care during the pandemic, 60 percent were women,” the researchers concluded.

According to AARP and the National Alliance for Caregiving, 61 percent of the family caregivers in 2020 were women, the majority of whom also held jobs. Of the caregiving population, 45 percent experienced at least one financial impact, such as draining short-term savings or taking on more debt, during the calendar year.

As day care centers and schools close amid the pandemic, many women have no choice but to leave the labor force to care for dependent children.

“Even more women have had to choose to stay home with their children to support virtual learning because they don’t have the flexibility to make it work. Women are not going to choose between the safety of their children and their jobs.” Griesmer told Annuity.org in an email.

Before the pandemic, some women relied on their own parents for assistance with child care. These retired grandparents account for approximately 41 percent of the caregiving population and are among the most vulnerable to hospitalization and death as a result of COVID-19. To avoid exposure to the virus, grandparents have had to isolate themselves from their families, leaving many mothers without their support system.

The economic climate coupled with the long-standing effects of COVID-19 has challenged livelihoods in the workforce, particularly women. In fact, as if societal pressures weren’t enough, having to choose between going into the job place or staying home to care for family became a general topic.

Although, through continued efforts of women’s economic empowerment and gender equality as the world restores, there is progress toward a sustainable future in the workplace.

Labor Force Sectors Where Women Face the Most Significant Challenges

Working women of all backgrounds and socioeconomic statuses have been subject to financial adversity because of the pandemic, but some groups face unique challenges.

Front-Line & Essential Workers

Although front-line workers and other essential employees may not have encountered industry-wide job losses, many face safety and health concerns. The pandemic has affected the balance between financial and emotional well-being, as these employees juggle their careers with their personal needs.

Consider the dilemma of a respiratory therapist who recently completed chemotherapy. With a weakened immune system, should the therapist continue to go to work and risk exposure to the coronavirus? Perhaps a grocery store manager cares for an aging mother at home. Can the manager keep working in a busy store, coming into contact with many people every day and ensure the mother’s safety?

These are challenges faced by both male and female front-line and essential workers, but the smaller percentage of men who serve as caregivers translates to fewer job losses among men in these positions.

Service Industry Employees

With social distancing and occupancy restrictions in effect, the service industry faced unprecedented challenges. Some organizations have had to significantly change their business practices. For example, a large number of restaurants now offer delivery or grab-and-go options to discourage public gatherings. Other businesses have had to lay off staff members or close their doors indefinitely.

The service sectors hit hardest by the coronavirus, including hospitality, retail and child care, employ a disproportionate percentage of women of color. The BLS reported in its January 2021 jobs report that employment in leisure and hospitality was down by 3.9 million, or 22.9 percent, since last February. The 597,000 jobs lost in this sector in the months of December and January represent the largest decline among all nonfarm jobs during that time period.

Service jobs have historically paid lower wages and are generally less likely to provide benefits such as health insurance, child care, paid leave and retirement plans. This means that women who have been working in this industry are less likely to have enough savings to see them through a prolonged period of unemployment or investments to shore up their retirement.

Furthermore, a significant number of these positions lack the flexibility of remote work, as they entail front-facing service. In-person work has not resumed yet for many — and never will, for some.

Small Business Owners

The pandemic has threatened the financial viability of many women-owned businesses. As the coronavirus spread, entrepreneurs saw limited foot traffic and, subsequently, faced difficult decisions such as reducing personnel or filing for bankruptcy.

The U.S. Chamber of Commerce released data that showed female-owned businesses were less optimistic than male-owned businesses about growth in revenue, investments and staffing following the onset of the pandemic. Prior to the first reports of the coronavirus in the United States, 67 percent of male-owned small businesses reported that their businesses were in good financial health, compared with 62 percent six months later in July 2020. Among female business owners, only 60 percent reported good financial health before the coronavirus, with a significant drop to 42 percent in July.

Before the pandemic, female-owned small businesses were rapidly growing. In 2017, The Women’s Business Enterprise National Council reported that “1,821 net new women-owned businesses were launched every day. Women of color founded 64 percent of those new businesses.”

But even then, banks and investors underserved female entrepreneurs, with only 2 percent of investors’ seed funding supporting women business owners. Studies have shown that women ask for less money, receive smaller loans and are charged higher interest rates than their male counterparts.

Women entrepreneurs have historically dealt with discrimination from banks and venture capitalists, but the COVID-19 crisis has significantly impeded the growth of women-owned businesses.

Damage Control and Financial Recovery

If you’re a woman whose financial health has been affected by COVID-19, you’re not alone. Although the statistics paint a grim picture, help is available.

“This is the time to build our communities,” Andi Wrenn, treasurer of the Association for Financial Counseling & Planning Education, told Annuity.org. “Lift each other up. Share with others what your thoughts are. Ask others what they think of your ideas to move forward. Talk to an [accredited financial counselor] to get your financial goals set and aligned with your values. Working with someone in your local community might help you to learn of programs available in your area.”

From health insurance providers to multinational financial services corporations, companies are considering the needs of women at this critical time. Many service providers are seeking to strengthen relationships with female business owners by offering new services, programs and action plans in an effort to promote positive progress for women.

For example, in Indiana, IU Health is expediting the processing of over $5 million a week in billings to in-state vendors, including small businesses and women- and minority-owned enterprises.

Mastercard launched its Path to Priceless initiative in 2020 to “reaffirm its commitment to women entrepreneurs” and “shine a light on their journey and provide a curated calendar of physical and digital advisement and mentorship opportunities.”

Taking advantage of all the available resources for which you are eligible will not only keep you afloat financially in your immediate circumstances, but it will also bolster your future financial security.

Protecting Your Retirement Savings from the Effects of COVID-19

Even before the pandemic, a LIMRA survey revealed that 46 percent of women, compared with 35 percent of men, reported concerns about their financial stability after retirement. With 2.3 million more women leaving the labor force as of 2021, concerns about the future are heightening for many.

“Right now, our main concern is the joblessness that women are facing,” Griesmer said. “When it comes to retirement savings, many women do not have access to retirement savings through their employers, as many work hourly or low-wage jobs without this benefit; those with the benefit are now forced to give that up, as they are leaving their jobs; those that do have savings are often not advised in the same way that their male counterparts are.”

Depending on how close you are to retirement, you may have been thinking about retirement income before the pandemic. You may have an annuity that will provide you with a guaranteed income stream or investments that you expect will appreciate.

Without some form of supplemental income, you will likely be reliant upon payments from a qualified retirement plan and Social Security benefits to cover your expenses in retirement.

“The important thing when thinking about retirement savings is to leave money in your accounts, if possible. Paying your future self is important.”

Andi Wrenn, Treasurer, AFCPE

Breaks in employment can result in less retirement savings and lower Social Security income benefits. You’ll need a strategy to offset those losses, starting with reducing debt, thus avoiding excess interest charges and fees. Most advisors and credit counselors recommend paying off high-interest debt or transferring balances to low-interest credit cards before building your savings. Gaining control of your debt means you’ll be able to save more.

“For many, it helps to have a group of professional women who support you and will listen to your ideas and help you flesh out a new plan to make an income to replace what is lost,” according to Wrenn. “The important thing when thinking about retirement savings is to leave money in your accounts, if possible. Paying your future self is important.”

Make a Plan to Eliminate Debt

The owner and CEO of Money Talk Financial Planning Seminars and Publications, Barbara O’Neill, recommends revising budgets to reflect changes in income and expenses. Categorizing needs, obligations and wants can highlight areas warranting more savings.

Shifting your mindset can be helpful, too. Rather than focusing on the issue, channel your energy toward solution-oriented actions.

Cindy Hounsell, president of the Women’s Institute for a Secure Retirement, told Annuity.org that changing perceptions is a key step for women. “This is going to change, so how am I going to make this different for myself? How am I going to succeed, and what do I need to do to make that happen?”

“This is going to change, so how am I going to make this different for myself? How am I going to succeed, and what do I need to do to make that happen?”

Cindy Hounsell, President, WISER

Christie Angel, President and CEO of the YWCA Columbus, suggests setting small goals and taking “small bites,” or chipping away at debt. For example, choosing to save $3 each day instead of buying a cup of coffee at a café could save someone $15 each five-day work week, or $60 monthly. Small savings can add up over time.

Women can also speak directly to their lenders, utility companies and credit card companies to discuss options for lowering payments or refinancing.

Additional relief and support systems — including food pantries and student loan deferral programs — can relieve some of the financial burden for women who need to prioritize other costs, such as rent and electricity.

Missed payments could result in subprime credit scores, so resolving debt and rebuilding are critical steps to consider.

Make Up for Withdrawals from 401(k) and Other Retirement Plans

It is important to address current financial challenges, but once the bills are paid, women can begin to shift to saving. Unfortunately, many Americans had to tap into their retirement savings to cover their debts.

“People are basically losing two things when they either stop saving or they have to pull money out of savings,” O’Neill told Annuity.org. “There is some tradeoff there. You are losing your savings, and you are losing the growth on that savings.”

“People are basically losing two things when they either stop saving or they have to pull money out of savings. There is some trade off there. You are losing your savings, and you are losing the growth on that savings.”

Barbara O’Neill, Owner and CEO, Money Talk

Some women approaching retirement have chosen to work longer than they’d anticipated. A wide range of financial products and investment options are also available, and they can align with different budgets and personal circumstances.

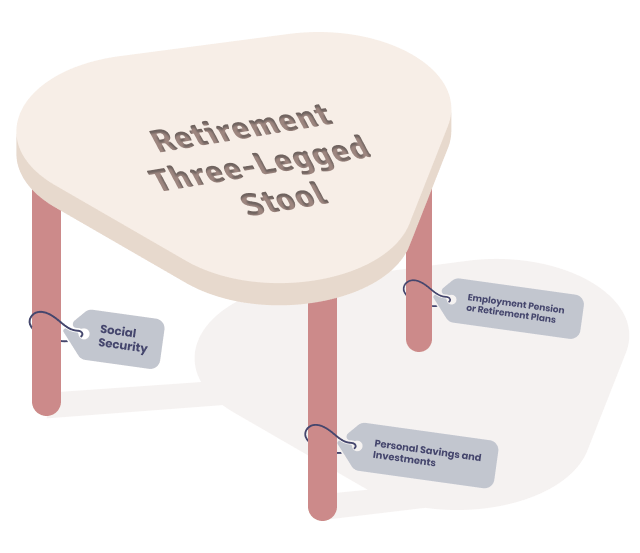

WISER defines retirement as a three-legged stool; if any of the three legs is wobbly or incomplete, the stool cannot stand.

David Babbel, professor of insurance and finance at The Wharton School of the University of Pennsylvania in Philadelphia, explained in a research paper on lifetime income for women, “Lifetime-income annuities should make up 40 percent to 80 percent of a retirement portfolio, especially for women.” Setting aside savings now can set women up for steady income later.

Beyond adjusting their savings and retirement plans, women should also review their estate plan. Even if you already have a durable power of attorney and a living will, you may need to update these documents based on your assets, income and other life changes.

Women can also seek financial advice from a professional, thereby building capacity to make important decisions for their financial portfolios. Financial planners and counselors seek to understand the context of their clients’ situations, then provide helpful suggestions specific to their needs and abilities.

According to LIMRA, “women are less confident than men that they will be able to live their desired retirement lifestyle. This is likely because, on average, women live longer, are more likely to need long-term care, are more likely to be caregivers themselves, and are more likely to earn and have saved less than men.”

What Is an Annuity?

Find out more about how an annuity can help fund your retirement with guaranteed income for life.

Resources for Women Whose Employment Status Has Been Affected by COVID-19

Support services existed long before the start of the economic crisis, but many have updated or enhanced their offerings to address the heightened needs of working women.

“Vulnerabilities have been exposed with this pandemic,” Angel told Annuity.org. “If there is a bright light out of this whole thing, or some good, maybe it is a bit of a call to action.”

“Vulnerabilities have been exposed with this pandemic. If there is a bright light out of this whole thing, or some good, maybe it is a bit of a call to action.”

Christie Angel, President and CEO, YWCA Columbus

The federal government is creating and implementing policy solutions to address the wealth gap and provide relief for the 2.5 million American women who have left the labor force.

On March 10, Congress passed the American Rescue Plan Act of 2021. The stimulus package will provide $1,400 stimulus checks to eligible Americans and allocate $130 billion to safely reopen schools and prevent cuts to state pre-k programs.

Additionally, the White House announced that the plan “will provide over 14 weeks of paid sick and family and medical leave to help parents with additional caregiving responsibilities when a child or loved one’s school or care center is closed; for people who have or are caring for people with COVID-19 symptoms, or who are quarantining due to exposure; and for people needing to take time to get the vaccine.”

The American Rescue Plan and tax credits could directly support women aspiring to return to work.

The goal is to put tools in the hands of female workers, so they may accept any available assistance and make informed decisions for their financial futures.

Financial Support Services

Women’s Institute for a Secure Retirement

WISER is an organization that provides education and advocacy for women in pursuit of financial security. They achieve this through training, informational materials and organizational partnerships.

Coordinated Assistance Network

The Coordinated Assistance Network (CAN) is partnering with AFCPE and Wells Fargo to offer free financial counseling for anyone experiencing financial changes or hardship because of COVID-19.

Association for Financial Counseling & Planning Education

Visit AFCPE.org to explore what an accredited financial counselor can do to guide and support your financial decision-making. Some counselors may also offer pro bono, or free of charge, sessions.

2-1-1 network

2-1-1 is a confidential service that connects callers with human services, including COVID-19 information, help with paying bills, mental health support and other local support systems.

College and university-affiliated extension programs

Educational facilities in your area may offer opportunities such as job fairs, career coaching and mentorship.

Employer-sponsored financial planning support

Your current or previous employer may provide benefit packages, access to financial planning, options for saving for retirement and help increasing credit scores.

Small Business Resources for Female Entrepreneurs

National Association of Women Business Owners

NAWBO provides resources and advocacy to empower women entrepreneurs.

Mastercard’s Path to Priceless Initiative

Path to Priceless supports women entrepreneurs through mentorship and networking, in partnership with Create & Cultivate and Hello Alice.

SCORE

SCORE provides mentorship and education to promote and further small business success and growth.

U.S. Small Business Administration

The SBA’s Office of Women’s Business Ownership partners with districts to train, advise and support women entrepreneurs as they plan and build their businesses.

The pandemic has taken a toll on the country, and we’re not out of the woods yet. But women don’t have to tackle financial challenges alone. In fact, one of the few upsides to this crisis is a growing awareness of the disparities among our nation’s populations.

Voices that were previously silenced are being heard, and archaic systems are being scrutinized. In the meantime, women have the power to shape their futures. The path to sustainable financial security may be curvy and unpredictable, but women can reach their destination if they equip themselves with resilience, confidence and a wealth of reliable resources.